SÃO PAULO, Brazil, Jan. 30, 2020 (GLOBE NEWSWIRE) -- XP Inc. (Nasdaq: XP), a leading, technology-driven financial services platform and a trusted provider of low-fee financial products and services in Brazil, announced today select preliminary key retail performance indicators, (KPIs) for the fourth quarter ended December 31, 2019. The presented information is preliminary, unaudited and subject to revision. It reflects XP´s management’s current views and may change.

1. Assets Under Custody (AUC)¹ (R$ in billions) is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/cd6978c9-c49f-4ea7-ba5f-6a6291d52d5a

2. Active Clients² (‘000s) is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/342f9d5f-54ff-4d87-ab5d-7fbd10b3cd9d

3. Net Promoter Score (NPS)³ is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/da97e61f-b1a6-43d6-ad67-c898ca41ff7d

Guilherme Benchimol, XP Inc.’s CEO stated, “We are excited to deliver strong Key Performance Indicators for our retail business in the fourth quarter of 2019. These preliminary metrics reinforce the sustainability of our growth as we increasingly leverage our durable competitive advantages including our scale, superior product and services platform, differentiated technology, and our self-reinforcing ecosystem. We remain committed to continuing to execute on our strategies to build on our robust growth by increasingly penetrating our existing client base, expanding our ecosystem, and broadening our solutions capabilities. We look forward to building long-term value for all our shareholders as we move ahead in the coming years.”

Fourth Quarter Results Conference Call

The Company expects to release its complete fourth quarter and fiscal year 2019 financial results on March 17, 2020 after market-close. More details will be provided at a later date.

About XP

XP is a leading, technology-driven financial services platform and a trusted provider of low-fee financial products and services in Brazil. XP’s mission is to disintermediate the legacy models of traditional financial institutions by:

- Educating new classes of investors;

- Democratizing access to a wider range of financial services;

- Developing new financial products and technology applications to empower clients; and

- Providing high-quality customer service and client experience in the industry in Brazil.

XP provides customers with two principal types of offerings, (i) financial advisory services for retail clients in Brazil, high-net-worth clients, international clients and corporate and institutional clients, and (ii) an open financial product platform providing access to over 600 investment products including equity and fixed income securities, mutual and hedge funds, structured products, life insurance, pension plans, real-estate investment funds (REITs) and others from XP, its partners and competitors.

Forward Looking Statements

This press release contains "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are made as of the date they were first issued and were based on current expectations, estimates, forecasts and projections as well as the beliefs and assumptions of management. Words such as "expect," "anticipate," "should," "believe," "hope," "target," "project," "goals," "estimate," "potential," "predict," "may," "will," "might," "could," "intend," variations of these terms or the negative of these terms and similar expressions are intended to identify these statements. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond XP Inc’s control.

XP, Inc’s actual results could differ materially from those stated or implied in forward-looking statements due to several factors, including but not limited to: competition, change in clients, regulatory measures, a change the external forces among other factors.

| For any questions, please contact: | ||

| Carlos Lazar, Head of Investor Relations | Investor Contact:ir@xpi.com.br | |

| André Martins, Investor Relations Specialist | IR Website:investors.xpinc.com | |

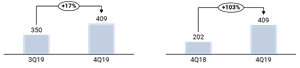

1. Assets Under Custody (AUC)¹ (R$ in billions)

¹ These amounts do not consider AUC from institutional clients such as RPPS (Public Service pension plans) and insurance companies.

2. Active Clients² ('000s)

² Active clients is the total number of retail clients served through XP’s brands with an AUC above R$100.00 or that have transacted at least once in the last thirty days.

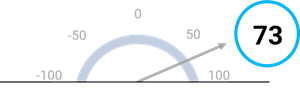

3. Net Promoter Score (NPS)³