The year 2018 has been one of the best in history for corporate profits. In the third quarter, more than 75% have reported a positive EPS surprise and close to 60% have reported a positive sales surprise.

America’s big businesses are reporting some of the strongest profit growth since the start of the financial crisis, on the back of lower tax rates and a healthy US economy.

The lower taxes have had the biggest impact on earnings. Last year, the US cut its corporate tax rate to 21% from 35%, which has allowed companies to make big savings. The fact that in the 2018, the US economy grew at a pace of around 3% also helped.

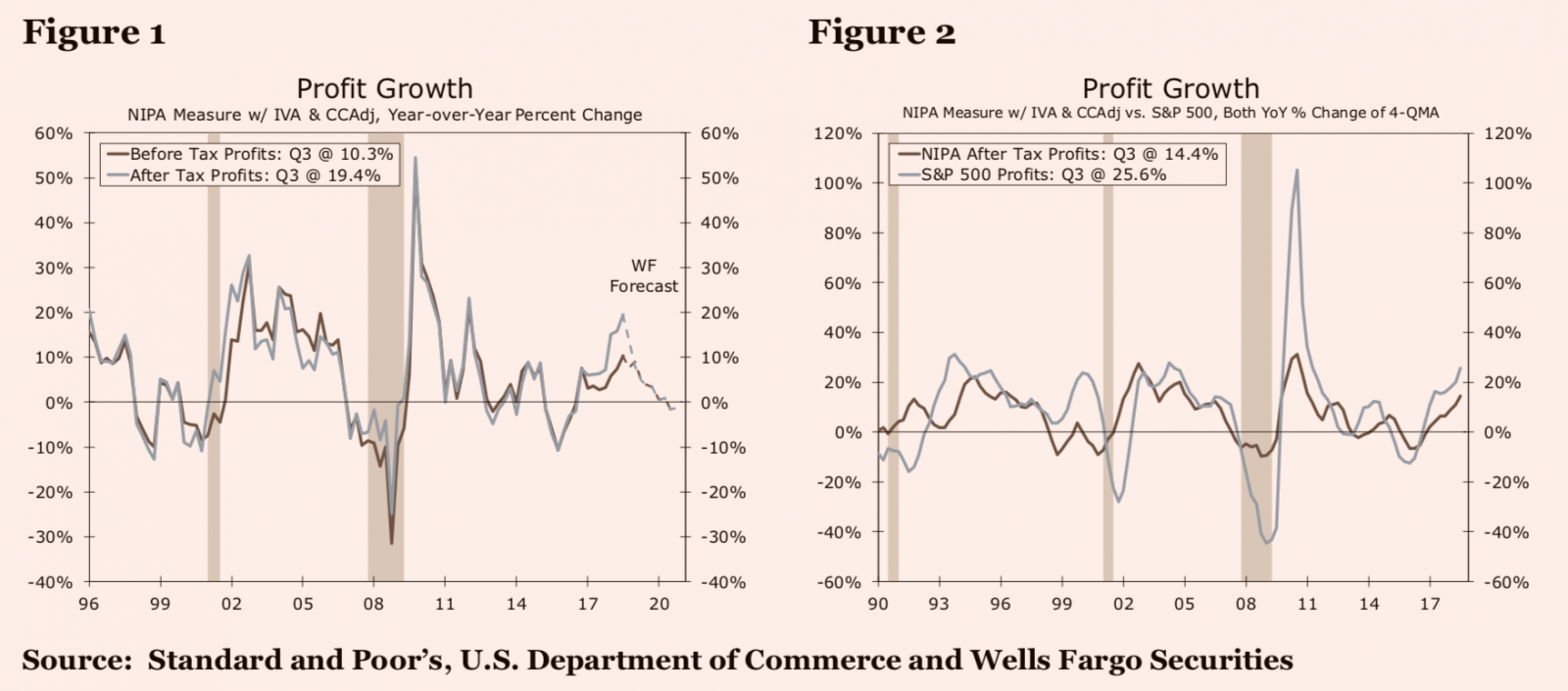

But profit growth is unlikely to be as strong in 2019, however, according to financial firm Wells Fargo. "Slower GDP growth and higher costs as the labor market tightens further and interest costs rise suggest profit growth is likely to have already peaked", it said in a report.

It forecast that before-tax corporate profits for the broad economy will increase only 5% in 2019 after increasing nearly 8% this year.

It sees a number of factors weighing on profit growth in the coming year, including slower GDP growth. And while sales growth is slowing, costs at corporations are rising due to higher interest rates, which will increase the cost of servicing the record amount of corporate debt. Input costs are also increasing amid strained resource availability.

"At 2.7%, GDP growth is anticipated to remain fairly solid, while stronger productivity growth is keeping a lid on unit labor costs. Should productivity growth and/or GDP growth weaken materially, however, the slowdown in profit growth would likely be more acute," says Wells Fargo. And furthermore, it sees the level of corporate profits peaking late in 2019 before edging lower in 2020. "Given that profits tend to peak a year or two before a recession, that could be troubling to investors as well as a headwind to investment and hiring in the year ahead."

By

By