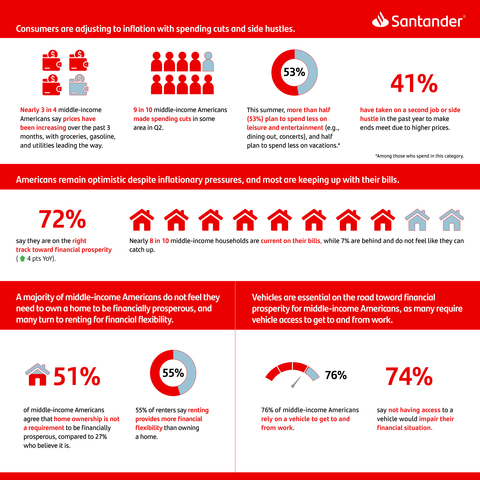

Santander Holdings USA, Inc. (“Santander US”) today announced findings from a new survey that shows middle-income households are cutting back on spending, taking second jobs, and delaying large purchases—such as cars and homes—to adapt to higher prices as inflationary pressures continue. Nearly three in four middle-income households (72%) reported seeing prices rise in the second quarter, and four in five (78%) said inflation is a major concern. To cope, most middle-income households (90%) have made spending cuts in at least one area, and many plan to curtail spending on a range of items this summer—from vacations to entertainment to summer camps and childcare. Four in 10 said they have taken on a second job or side gig in the last 12 months to help make ends meet.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240624053235/en/

(Graphic: Business Wire)

By making these trade-offs, many consumers have remained resilient despite higher prices, with eight in 10 middle-income households (77%) staying current on their bills. This helps to explain why the overwhelming majority of middle-income consumers continue to be optimistic about their financial futures, with most (72%) believing they are on the right track toward financial prosperity.

“While current economic conditions remain challenging, American households are showing great resiliency by taking the necessary actions to navigate through inflationary pain points,” said Tim Wennes, CEO of Santander US. “For many households, this has meant scaling back on spending, including summer activities. We understand consumers often face difficult choices in making these adjustments. At Santander, we are proud to be a resource and offer support to our customers as they make the necessary decisions that will help them achieve their financial goals.”

Most middle-income Americans (81%) say the high cost of housing is a major financial issue in the United States. Higher housing prices have led to a shifting view on the importance of homeownership, with many appreciating the flexibility of renting. Half of middle-income Americans (51%) believe that homeownership is not a requirement to be financially prosperous, compared to 27% who believe it is. Of those who rent, six in 10 believe having an affordable home, even if renting, is more important to achieving financial prosperity than having equity in a home.

The study, which built upon previous research, assessed middle-income Americans’ current financial state and future aspirations, with a focus on how current economic conditions have impacted their households. It also explored their financial relationships with drivers of prosperity, including vehicle access, housing, and banking providers.

Vehicle Access Vital for Consumers

Middle-income Americans believe that vehicles are critical for providing flexibility in their lives and access to employment. Nearly all (93%) own or lease a vehicle, and the majority (70%) would be willing to sacrifice other budgetary items to maintain a vehicle. Vehicle use reflects this demand, as more than half with a vehicle (53%) drive at least 10,000 miles each year. Most middle-income Americans (76%) rely on a vehicle to get to work, and 74% say not having access to a vehicle would impair their financial situation. Accessing a vehicle is becoming even more critical among younger generations. Four in 10 middle-income Americans have relied on a vehicle to perform gig work at some point, with Gen Z (57%) and millennials (50%) being the most likely to do so.

Housing Affordability and Preferences

As consumers contend with high housing costs, multifamily housing is a critical path for many to achieve financial prosperity. Middle-income Americans cite affordability (51%), ease of maintenance (35%), and better location (32%) as top reasons for choosing to live in a multifamily property. Seven in 10 middle-income Americans living in multifamily households are renting, an important option that provides them with more financial flexibility. Of those living in multifamily homes, the majority (71%) believe they are a good solution to produce more affordable housing options, and 65% say it allows them financial flexibility.

Banking and Savings

As consumers continue to face economic headwinds, they are turning to their banks for direction as they pursue their financial goals. Most middle-income Americans (79%) say they trust the financial information and guidance they receive from their bank. However, many have yet to take advantage of the opportunity to grow their savings in a high-rate environment. Six in 10 households have not moved their savings to receive a higher rate of interest since rates began to increase in 2022. Overall, more than half of those who know the interest rate on their savings are earning less than 3%, and more than one in five are not even aware of what they are earning.

This research on financial prosperity, conducted by Morning Consult on behalf of Santander US, surveyed 2,202 Americans who are bank and/or financial services customers, ages 18-76. Survey participants are employed or looking for work, own/use at least one financial product and are the primary or shared-decision maker on household finances, with household incomes in the “middle-income” range of ~$50,000 to $148,000. This Q2 study was conducted in May 2024. The interviews were conducted online, and the margin of error is +/- 2 percentage points for the total audience at a 95% confidence level. Percentages may not total 100 due to rounding. The data was weighted to target population proportions for a representative sample based on age, gender, ethnicity, region, and education.

The full report and more information about the Santander US survey is available here.

About Santander US

Santander Holdings USA, Inc. (SHUSA) is a wholly-owned subsidiary of Madrid-based Banco Santander, S.A. (NYSE: SAN) (Santander), recognized as one of the world’s most admired companies by Fortune Magazine in 2024, with approximately 166 million customers in the U.S., Europe and Latin America. As the intermediate holding company for Santander’s U.S. businesses, SHUSA is the parent company of financial companies with more than 11,800 employees, 4.5 million customers, and assets of over $165 billion in the fiscal year ended 2023. These include Santander Bank, N.A., Santander Consumer USA Holdings Inc., Banco Santander International, Santander Securities LLC, Santander US Capital Markets LLC and several other subsidiaries. Santander US is recognized as a top 10 auto lender and a top 10 multifamily bank lender, and has a growing wealth management business. For more information about Santander US, please visit www.santanderus.com.

About Santander Bank, N.A.

Santander Bank, N.A. is one of the country’s leading retail and commercial banks, with $102 billion in assets. With its corporate offices in Boston, the Bank’s more than 5,100 employees and more than 1.8 million customers are principally located in Massachusetts, New Hampshire, Connecticut, Rhode Island, New York, New Jersey, Pennsylvania and Delaware. The Bank is a wholly-owned subsidiary of Madrid-based Banco Santander, S.A. (NYSE: SAN), recognized as one of the world’s most admired companies by Fortune Magazine in 2024, with approximately 166 million customers in the U.S., Europe, and Latin America. It is overseen by Santander Holdings USA, Inc., Banco Santander’s intermediate holding company in the U.S. For more information on Santander Bank, please visit www.santanderbank.com.

Santander Bank, N.A. is a Member FDIC and a wholly owned subsidiary of Banco Santander, S.A. © 2024 Santander Bank, N.A. All rights reserved. Santander, Santander Bank, the Flame Logo are trademarks of Banco Santander, S.A. or its subsidiaries in the United States or other countries. All other trademarks are the property of their respective owners.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240624053235/en/