In the end, the hardest thing is not to find long-term winners, but to find winners that will perform well over the next three months, especially when you can't sell them along the way. The aim here is to build a high-performance, resilient selection. To achieve this, I rely on Evidence Based Investing, i.e. scientific research that has proven the relevance of certain investment strategies over time. This highly rational investment process has highlighted the relevance of certain investment factors, such as momentum.

In the classic sense of the term, momentum is an investment approach that favors stocks that have been on an upward trend over the past six or twelve months. At MarketScreener, momentum not only includes data relating to a stock's positive trend over the short (3 months), medium (6 months) and long term (12 months), a so-called "technical" momentum, but also analysts' revisions of earnings per share and sales over the short and long term, weighted by the number of shares in issue. This is a more "fundamental" type of momentum, assuming that analysts are rather conservative in their revisions.

The Momentum Picks selection is based primarily on two factors: Quality and Momentum. The quality factor favors companies with solid fundamentals, i.e. good profitability, high return on equity, strong balance sheets, low margin volatility and good visibility on future results.

.png)

.png)

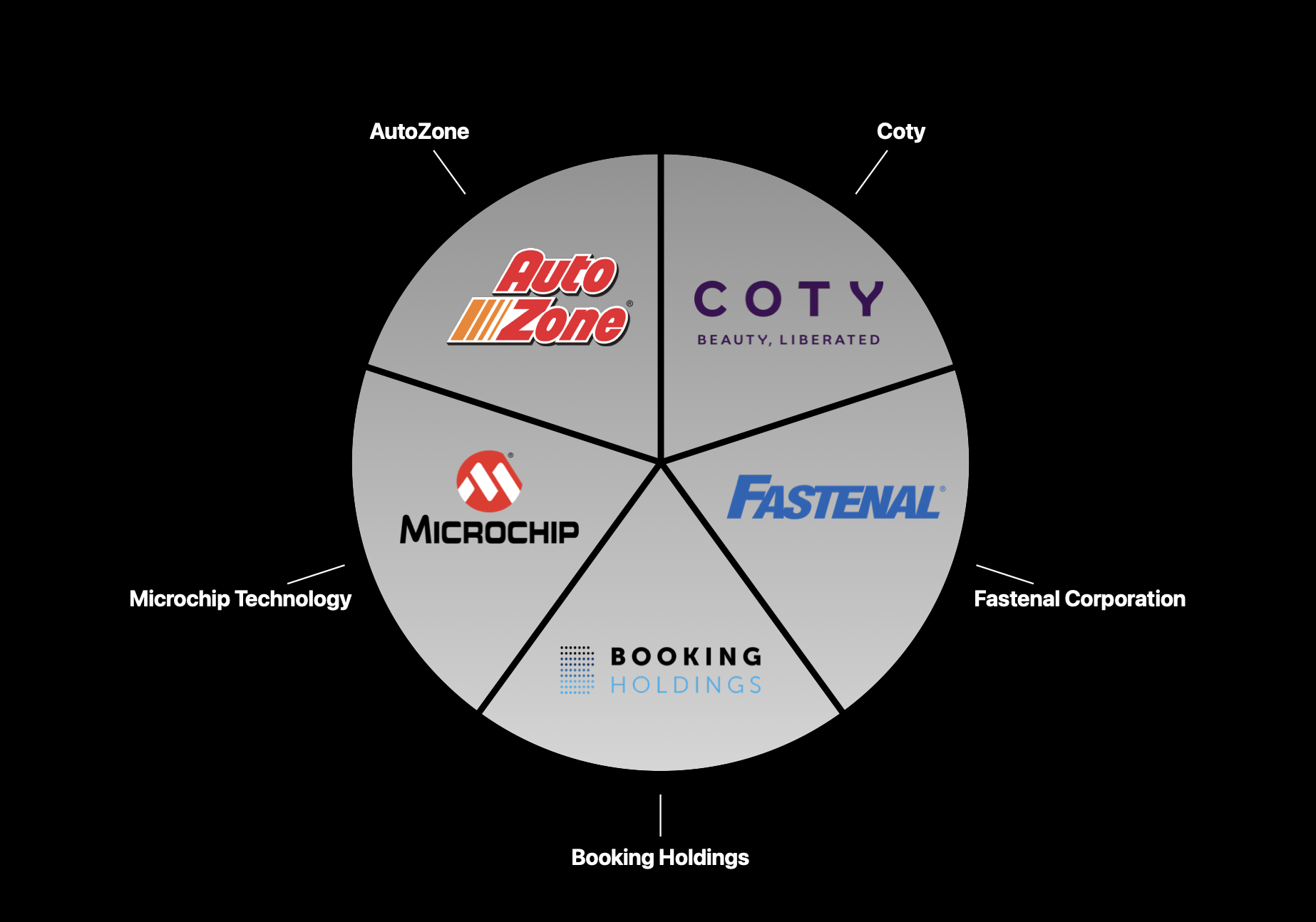

The new selection

Let's take a closer look at the five US stocks selected for the third quarter of 2023 (July to September).

Equal-weight Momentum Picks

AutoZone (AZO)

Cash in on Copart gains and buy AutoZone. AutoZone is an American retailer specializing in the sale of spare parts and automotive accessories, with nearly 7,000 outlets across America. Primarily based in the USA, the company also has stores in Puerto Rico, Mexico and Brazil. The company is part of the Consumer Discretionary sector. AutoZone sells to both private individuals and professionals. In particular, it supplies garages and service stations. It has a strong culture inspired by its founders. One of the main growth drivers for the stock has been massive share buybacks in recent years. TSR (Total Shareholder Return), including dividend payout, has averaged 18.5% a year over the past 20 years. This incredible performance is due to steady growth in sales and margins, as well as a sharp reduction in free float. In fact, AutoZone is a cannibalistic company that has eaten up almost half its free float over the last decade. The number of shares outstanding fell from 35,521 in 2013 to 18,156 in 2023. Operating margin stands at 20.1%, net margin at 14.9%, return on capital employed (ROIC) at 28.2% and weighted average cost of capital (WACC) at 6.8%. The balance sheet is solid, and financial leverage (debt/EBITDA) is less than 2. The company has been in existence since 1979, and has weathered recent crises without too many pitfalls. The rise of electric vehicles should not penalize it too much in the medium term. Demand is strong and steady.

Coty (COTY)

Coty is a company specializing in beauty products such as perfumes and cosmetics. It owns both its own brands and sub-licensed brands for major companies such as Hugo Boss, Adidas and Burberry. The company classifies its products into two segments: "Consumer beauty" (40% of sales) represented by the Adidas, Beckham, Biocolor, Bozzano, Bourjois, Bruno Banani, CoverGirl, Jovan, Mexx, Monange, Nautica, Paixao, Rimmel, Risque, Sally Hansen, 007 James Bond brands and "Prestige" (60% of sales) represented by the brands Bottega Veneta, Calvin Klein, Cavalli, Chloé, Davidoff, Escada, Gucci, Hugo Boss, Jil Sander, Kylie Jenner, Lancaster, Marc Jacobs, Miu Miu, Orveda, SKKN BY KIM, Tiffany & Co. Coty's fundamentals are more unstable than the other stocks in this selection. Growth has been flat for 10 years and the stock's run has been fairly chaotic since its IPO in June 2013. But things are changing. In my opinion, the current high level of debt can be brought under control by improving growth, profitability and free cash flow. The figures have been pointing in this direction for several quarters. Operating margin should be around 13% in 2023, as should return on equity, which should also be around 13%. EPS and sales revisions for the next few years have risen sharply. The stock is up 43% since the beginning of the year. Several catalysts could continue to drive value over the rest of the year: travel retail, China and even recession, if the lipstick theory applied to perfumes is to be believed.

Booking Holdings (BKNG)

Booking Holdings is one of the leading online travel agencies. The group offers a wide range of travel-related services: hotel reservations, car rentals, airline reservations, package holidays, tailor-made trips, cruises and more. It employs over 20,000 people and has a global presence. First and foremost, Booking is No. 1. The company has an incredible sustainable competitive advantage (called a "moat" in English) and is a perfect example of a company with a "network effect". Like LinkedIn or Wikipedia, Booking is "the place to go" when it comes to booking hotel accommodation, for the simple reason that it holds the world's largest available inventory. The quality of service is second to none, especially with the famous free booking option. It's rare for a business to combine industry dominance with unrivalled service quality. This is a direct credit to management. The company is paying itself 20 times its expected profits for 2023. This is reasonable in view of its solid fundamentals (FCF margin of 30%, ROE of 50%, solid balance sheet). With the company still benefiting from the reopening of the post-pandemic economy, 2023 should - like last year - be a banner year.

Fastenal Company (FAST)

Fastenal is a distributor of screws, nuts and other small tools founded in Winona, Minnesota, in 1967, and is number one in its sector. It is well known to investors for its unrivalled success, the stock having long been the best-performing financial instrument on North American markets. The stock is included in the Nasdaq 100 and S&P 500 stock market indices. The stock has enjoyed an almost uninterrupted upward trend since its IPO in 1987, and has achieved a stock market performance of some 12,000% to date (not counting dividends, which have risen to3.5 billion since its inception), against an S&P 500 lagging at less than 800% over the same period. It is also famous for its distinctive corporate culture, inherited from its mythical founder, Bob Kierlin, whom the press has called "the cheapest man in America". For Kierlin, every penny counts, and it is naturally this culture of frugality that explains the astonishing journey of a company with such a seemingly mundane activity. This is a remarkably well-managed company with a healthy culture, which has been able to reinvent itself and pivot before difficulties arose, maintaining its remarkable financial performance over time. This "family man" management style is also reflected in the balance sheet, with no net debt and current assets alone covering all liabilities more than three times over. This does not prevent Fastenal from posting a very high return on equity of 30%.

Microchip Technology (MCHP)

Already present in the two previous selections, Microchip is an American manufacturer of semiconductors for the household goods, automotive, IT and telecoms sectors. Its flagship products are microcontrollers, which account for over 56% of revenues, and programmable logic arrays (FPGAs for those in the know). Microcontrollers enable automation and are becoming increasingly indispensable in many devices, notably in the automotive and connected object sectors. The company should continue to grow this year, with strong demand from its customers. The Group's profitability is exemplary (net margin of 26% in 2023 and ROE of 54%). The valuation seems (still) cheap in relation to the company's quality and future prospects (18 times estimated earnings for 2023). Momentum is buoyant, and the sales and EPS revisions are in our favor. In line with its peers STMicroelectronics and Infineon Technologies and Microchip Technology should have (and are already having) a good year.

We'll be back at the end of September (09/30/2023) to review its progress and propose a selection for the following quarter.

By

By