Snowflake is a specialist in data management in the cloud. Its data analytics solutions are proving invaluable to customers who can aggregate, transfer, share and order massive amounts of data on a multitude of different platforms without the need for complicated APIs or vulnerable exchange protocols. The centralized data can thus be distributed to a multitude of actors orbiting around the center... a "snowflake" organization, which naturally inspired the company's name. The flexibility of the offer also allows third parties to graft themselves onto this ecosystem to develop and sell their own solutions on a large scale. There is therefore a platform effect that guarantees both the ubiquity of the solution and erects good barriers to entry. Snowflake is also found in the triumvirate of the global cloud, Amazon, Microsoft, Google.

An IPO widely covered by the media

The company will celebrate its tenth anniversary this year. In 2012, the boss of the venture capital fund Mike Speiser created the company with two frenchmen, Benoît Dageville and Thierry Cruasnes. Berkshire Hathaway invested right from the IPO, which is quite unusual as Warren traditionally never participates in IPOs. An investment certainly undertaken under the responsibility of one of his two lieutenants (Todd Combs or Ted Weschler) rather than Buffett himself. Perhaps they were seduced by the company's insane growth rates, the hallmark of many IPOs in the technology sector during this period.

Let's not forget that Snowflake was valued at $3.5 billion in 2018, then $12.4 billion in early 2020 and finally $33.3 billion based on the IPO price of $120. This means that the venture capital funds present in the capital have made an excellent operation, better than the shareholders who have entered the file since, if we exclude the subscribers of the IPO or those who have left since in an appropriate timing. In this type of operation, it is always good to reflect on the motivations of the sellers and the buyers.

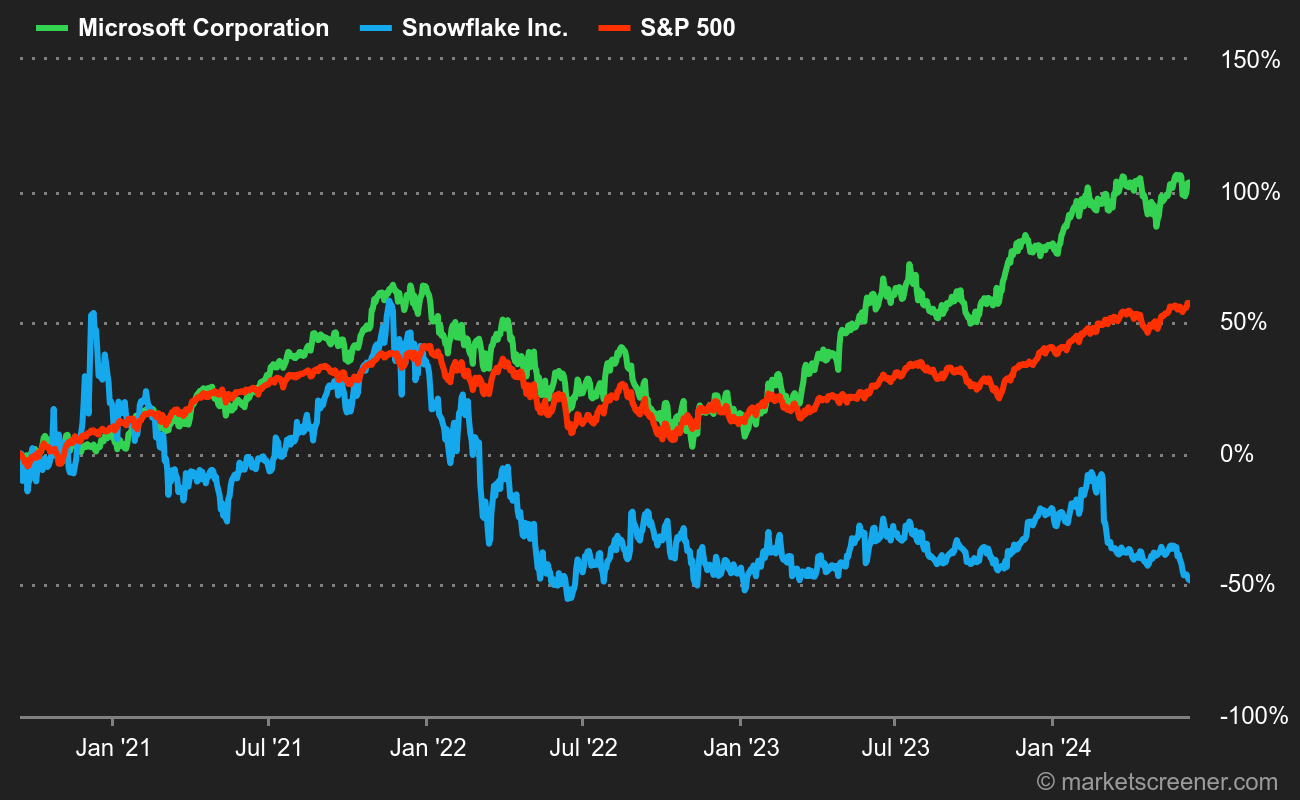

From 400 to 126 USD in six months

What followed was much more chaotic, with two interludes above USD 400 per share. Since the last peak last November, the share price has continued to fall until it reached a low of USD 126 a few days ago, barely above the IPO price. The division by three of the market capitalization in six months has led some bold analysts to compare Snowflake in 2022 to Google post financial crisis, when the tech giant with a monopoly on web search was quoting at its lowest historical levels. But with one major difference: ex-cash and ventures, Google was trading at 10 or 12 times its then profits, while Snowflake has never made a single cent in cash and is trading at 20 times its revenues.

The speculative dimension remains very strong and any hasty comparison seems fanciful. We have to keep our wits about us. Rather than Google, the most immediate comparison would be with Amazon: IPO in 1997 at USD 18 per share, price jumping to USD 105 in two years during the dotcom bubble, then falling sharply to USD 6. It took a full decade for Amazon's share price to recover to its previous highs. It is sometimes useful to remember that behind success stories, there is not always a long quiet river.

29 times 2029 profits

However, the management communicates very ambitious projections: $10 billion in sales by 2029, i.e. a five-fold increase in revenue in seven years, with a cash profit margin (free cash flow) of 15%. Even based on these (necessarily optimistic) management projections, the expected return on investment by then is quite insufficient to consider taking such a risk. Especially if we take into account the inevitable dilution caused by the plethora of stock option payments, which represented $600 million last year, or half of the expected turnover this year. This tendency to overpay executives and employees is now a well-established practice in the technology sector.

Snowflake's goal is to reach operating breakeven next year, before rolling out the plan to those famous 2029 targets. But let's assume that management's projections are correct: cash earnings should reach $1.5 billion in seven years, or a multiple of 29 times earnings based on current capitalization (in this diagram, note that we do not include dilution from stock options). On this basis, the valuation appears reasonable for a company in very strong growth, if rates remain low. But as we are talking about the profit made in 2029, the case suddenly looks less sexy. It is worth noting that the company's impressive reserves should protect it from raising funds once the cash-burn is no longer negative.

In short, Snowflake remains an indisputable speculative stock even after correction. Insiders seem to think so too, as CEO Frank Slootman sold $600 million worth of shares right at the peak of the valuation, as did CFO Michael Scarpelli, who sold $241 million worth of shares. Actions speak louder than statements and for now, Snowflake will have enriched its first investors and management.

By

By