Growth > Value

In the United States, the Russell 2000 posted a weekly performance of over 7%, outperforming the S&P 500 (+1%) and a sluggish Nasdaq 100 (-0.3%). It thus reached its highest level in two and a half years. The index is reacting positively to expectations of interest rate cuts by the US Federal Reserve (Fed), particularly after the latest inflation data.

Companies in the bio-sciences and bio-pharmaceuticals sector were the main contributors to this rise, with outstanding performances from Lantheus Holdings (+56%), IGM Biosciences (+55%), Sutro Biopharma (+39%) and BioAtla (+38%). Hopes of monetary easing augur well for these sectors, which could finance their costly projects more cheaply thanks to cheaper debt.

In addition, nearly 52% of companies in the index reported better-than-expected first-quarter results. Average sales rose by 0.7%, exceeding the 0.4% expected.

Performance since last week

Performance since last week

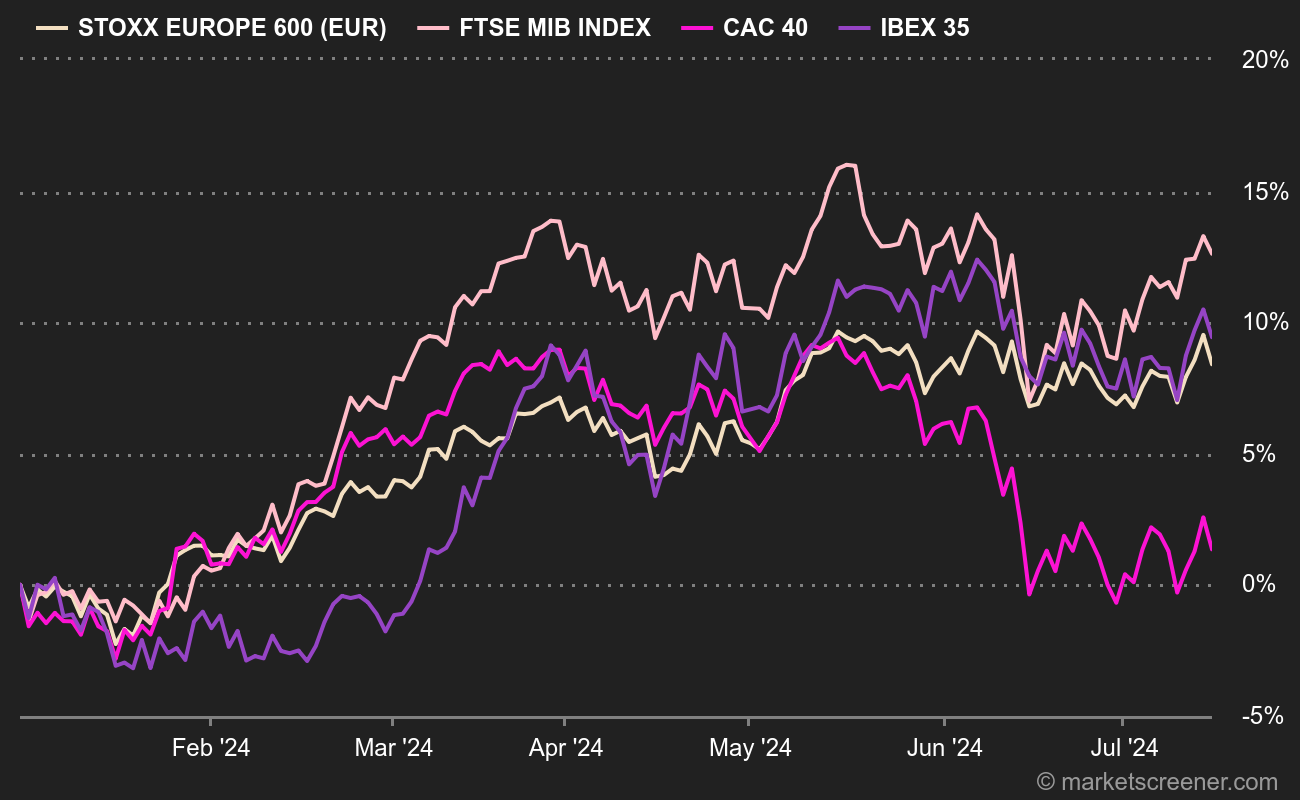

Parmesan outperforms Mimolette and Manchego

While the Spanish team La Roja were crowned European soccer champions and France shone in political entertainment, Italy emerged as the year-to-date stock market champion, far ahead of its Latin counterparts.

The FTSE MIB has significantly outperformed the European benchmark index Stoxx Europe 600 , as well as the CAC 40 andIBEX 35 . It has been trading at all-time highs for over a year, on an almost unflappable upward trajectory.

By

By