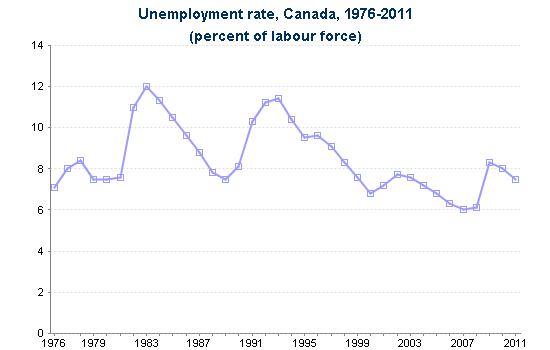

In 2011, Canada had a 2.5% GDP growth rate, public debt amounted to 83.5% of GDP and an unemployment rate of 7.5%.

Although Canada has weathered the crisis thanks to its banking system, some provinces are now in financial trouble because they have accumulated deficits.

On the other hand, unemployment has grown too, but according to the latest OECD report on the subject,”the recovery of the Canadian labor market is well under way”.

In addition, according to a report recently released by the CD Howe Institute, Canadian businesses will invest CAD 1.05 per worker in 2012 while it was CAD 0.92 in 2003. This statistic is even more significant that Canada outperforms the average in OECD countries.

Investment is a key driver of economic growth. Although this is relative performance in a global crisis, Canada is a developed country where growth prospects are the strongest for the coming years.

…confirmed by Surperformance ratings…

According to Surperformance tools, the development of sales in Canada is expected to increase significantly compared to other advanced countries, for the three coming years. Indeed, “Growth” rating of the second largest country in the world is one of the best.

Another interesting fact, Canada is the third developed country in terms of “Potential” rating. Analysts seem very optimistic about the evolution of Canadian stock prices since they have target price much higher than those currently prevailing.

In addition, they are also very optimistic for another reason: “Consensus” rating, after the United Kingdom, is the highest. This means that a large percentage of Canadian companies benefit from “Buy” recommendations.

…and that benefit to Canadian businesses…

| Company | Sector | Trading rating | Investment rating |

| ALIMENT.COUCHE-TARD | Food Distribution/Stores | 100% | 100% |

| WESTJET AIRLINES LTD | Airlines | 99% | 99% |

| TRANSFORCE INC | Rails/Roads - Freights | 98% | 93% |

| MULLEN GROUP LTD | Oil Related Services/Equipment | 66% | 87% |

| TOROMONT INDUSTRIES | Business Support/Supplies | 75% | 86% |

| FINNING INTEL. | Business Support/Supplies | 85% | 85% |

| CANADIAN TIRE-A | Retail - Specialty | 95% | 85% |

| MAGNA INTERNATIONAL | Auto/Truck/Motorcycle Parts | 98% | 84% |

| AGRIUM INC | Chemicals - Agricultural | 86% | 83% |

| STANTEC INC | Business Support/Supplies | 96% | 79% |

Here there is a selection of Canadian companies thanks to the Surperformance Market Screener. You can find the rest of the list here.

Among this list, there is only one mining company, Agrium, while Canada is a land rich in natural resources. The Saskatchewan stock price has sharply increased in the last few weeks, riding the wave of drought affecting the agricultural world. Once the crisis is over, it may have limited upside potential.

A company to watch is WestJet Airlines that grows and can enjoy the current woes of Air Canada. The airline company of the list has excellent fundamentals.

Finally, a recovery in the automotive sector could benefit greatly to Magna International. To avoid the weak European market to which the company is exposed, the development of its electric car, the E-Car, is an edge.

Glossary of Surperformance rating:

Growth (Revenue)

Growth rating is based on the evolution of the turnover of the company between the last year and the three coming years according to consensus estimates. The higher the growth is (from a relative viewpoint), the better the rating is. The goal is to rank companies according to estimated sales and to identify companies with the highest growth.

Potential

Potential rating is based on the average target price fixed by the consensus from Thomson Reuters. The higher the target price is, the better the rating is. The goal is to identify companies that have, according to analysts, the strongest upside potential.

Consensus

Consensus rating is based on analyst recommendations. It provides an indication of the position taken by most analysts polled by Thomson Reuters. The goal is to identify companies that benefit from the maximum of buy (or sell) recommendations.

Follow @MMarksJr

By

By