RE/MAX Canada anticipates average residential prices in recreational markets to rise up to 20 per cent for the remainder of 2022

- 39 per cent of Canadians living in recreational markets are drawn to their affordability, while lifestyle is also a key factor, such as access to water (37 per cent), access to outdoor recreation (33 per cent), and low-density neighbourhoods (31 per cent).

- 75 per cent of Canadians living in recreational markets are happy with their quality of life.

- Growing interest and activity in recreational markets is a concern for current residents, with 54 per cent of those living in recreational markets worried that a rapidly rising population will impact their community's charm and liveability, and 41 per cent showing concern about future affordability.

TORONTO and KELOWNA, BC, May 11, 2022 /CNW/ -- Interest in Canada's recreational property markets has continued to grow since the start of the pandemic, drawing homebuyers with their relative affordability and attractive lifestyle, but leaving many current residents concerned that a rising population could negatively impact their community's charm and liveability (54 per cent) and affordability (41 per cent), according to new data from RE/MAX Canada. As a result of heightened interest and activity in recreational markets, coupled with a housing supply shortage, RE/MAX Canada brokers and agents anticipate average residential prices to rise up to 20 per cent for the remainder of 2022.

"The level of activity we are seeing in recreational markets across the country is a direct reflection of the stability and quality of life that these regions provide," says Christopher Alexander, President, RE/MAX Canada. "Throughout the pandemic, we saw a shift in consumer behaviour, where in many cases liveability and affordability trumped all other factors. Yet, many recreational properties, whether as a primary or secondary residence, afford buyers the best of both worlds, compelling Canadians to settle in these areas for the long term. This is putting upward pressure on these markets."

According to a Leger survey conducted on behalf of RE/MAX Canada, 75 per cent of Canadians living in recreational markets are happy with their quality of life. Sales activity in these regions has been driven in large part by young couples and families, retirees, out-of-town buyers and investment buyers, according to a supplemental survey of RE/MAX brokers and agents, who said waterfront properties with open space living and large acreage are in greatest demand.

"Historically, recreational properties are held within and passed down through families, which has been a strong contributor to low inventory in those markets," says Elton Ash, Executive Vice President, RE/MAX Canada. "With the prospect of declining affordability for many homebuyers across the country, more and more Canadians are choosing to live in recreational areas because of the relative affordability they offer. In many cases, this has resulted in heightened demand for homes in regions that were already experiencing low supply, and could soon be facing more acute challenges of a growing population."

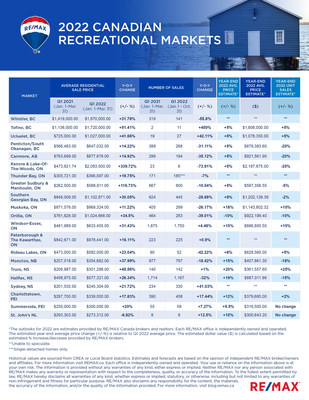

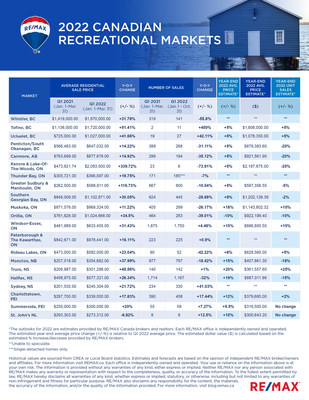

Among the impacts are rising residential prices. In fact, the majority (76 per cent) of RE/MAX Canada brokers and agents are anticipating residential price growth up to 20 per cent through the remainder of 2022. Markets such as Kenora/Lake-Of-The-Woods and Greater Sudbury/Manitoulin Island experienced exponential year-over-year price appreciation of 339.72 per cent and 116.73 per cent, respectively. Local RE/MAX brokers report that prices in these areas will likely remain accessible for many looking to enter the housing market, especially out-of-area buyers coming from larger and more expensive cities across Canada.

Despite Canadians returning to in-person work, the trend of inter-provincial migration into recreational markets as a primary place of residence is likely to continue for the remainder of 2022, with liveability and affordability propelling the movement, according to RE/MAX brokers and agents. While many current residents are expected to remain in the area – signalling added pressure on inventory in recreational markets – the Leger survey reveals that 24 per cent of Canadians who live in a large urban city would like to purchase a recreational property within the next two years. Meanwhile, many of those living in a recreational market have no plans to relocate to a bigger city (population size under 100,000, 43 per cent); or to a large urban city (population over 100,000, 50 per cent).

Regional Deep Dive into Canadian Recreational Markets

RE/MAX Canada brokers and agents were asked to provide an analysis of their local market activity for the first quarter of 2022, as well as an outlook for the remainder of the year.

Atlantic Canada

RE/MAX Canada surveyed brokers in Truro, NS, Sydney, NS, Charlottetown, PEI, Summerside, PEI, St. John's, NL, Moncton, NB and Halifax, NS, and found that all but one market are sitting in seller's territory. Only Sydney, NS is a buyer's market. This trend can be attributed to the supply-demand imbalance that brokers expect to continue through the remainder of 2022. Average recreational property price increases are expected in Truro (+20 per cent); Charlottetown (+12 per cent); Summerside (+ 5.5 per cent); St. John's (+10 per cent); Moncton (+15 per cent); and Halifax (+19 per cent).

Out-of-province buyers are settling into the area for the long-term and are leading market activity in Atlantic Canada among other stakeholders, with waterfront properties being most sought after by consumers. Between January and March of 2022, year-over-year average residential sale prices have increased by 46 per cent in Truro; 22 per cent in Sydney; 18 per cent in Charlottetown; 20 per cent in Summerside; 38 per cent in Moncton; and 26 per cent in Halifax, NS. The only region that experienced a decrease in year-over-year average residential price was St. John's, which declined by approximately seven per cent. RE/MAX brokers and agents in Atlantic Canada anticipate their recreational markets to continue to be sought after by out-of-province buyers and in some cases new immigrants, as governments encourage local migration to the area.

Ontario

Ontario's recreational communities are no exception to the seller's market conditions that are prevalent nationwide, with all regions reporting low inventory and high demand. According to RE/MAX brokers and agents, residential sale prices in recreational markets are expected to grow by 10 per cent in Windsor-Essex; five per cent in Kenora and Lake-Of-The-Woods; five per cent in Greater Sudbury and Manitoulin Island; nine per cent in Southern Georgian Bay; 18 per cent in Muskoka; eight per cent Rideau Lakes. Meanwhile, Orillia is expected to cool slightly, with a 10-per-cent decline anticipated through the end of 2022, compared to the 34.5-per-cent price growth experienced in the first quarter of the year.

Ontario recreational market activity is being driven by a range of buyer types, including out-of-province buyers, singles, millennials, retirees, families and young couples, as well as investors, showing particular interest in waterfront properties. Recreational markets have also been a hot spot for investors, with brokers in Windsor-Essex, Peterborough & Kawartha Lakes, Southern Georgian Bay and Orillia reporting them as primary players in their regions. Despite accelerated buying activity in the wake of the pandemic – particularly by Southern Ontarians – some markets such as Kenora/Lake-Of-The-Woods are expected to regain balance in the remainder of 2022, as Canadians return to the office and activity wanes in some markets.

Western Canada

Western Canada's recreational markets are all skewed toward sellers, including British Columbia's Tofino, Ucluelet, Whistler and Penticton/South Okanagan regions, as well as Canmore, AB. Demand in these areas has continued to thrive, with recreational properties for sale in Whistler and Canmore receiving multiple offers in a trend that has been exacerbated by dismal inventory. Although many pandemic-related restrictions have lifted, RE/MAX brokers in these regions anticipate continued interest from Canadians as shifting attitudes and high gas prices are prompting many to vacation closer to home. Average sale prices are estimated to increase by five per cent in Tofino, Ucluelet, Penticton/South Okanagan and Canmore in the remainder of 2022.

About RE/MAX Canada's 2022 Recreational Market Report:

The 2022 RE/MAX Recreational Markets Report includes data and insights supplied by RE/MAX brokerages. RE/MAX brokers and agents were surveyed on market activity and local developments based on local board data and market activity in 2021 and 2022. *Small markets were defined as those having the highest population growth rates in 2021, according to Statistics Canada, and population under 440,000, with a secondary criterion in order to ensure a good sample of national markets of those with a population of 100,000 or less. **Recreational markets were defined as an area with properties most used for leisure (i.e., a community with recreational amenities like a lake/river/skiing etc.).

About Leger

Leger is the largest Canadian-owned full-service market research firm. An online survey of 1,525 Canadians was completed between March 25-27 using Leger's online panel. Leger's online panel has approximately 400,000 members nationally and has a retention rate of 90 per cent. A probability sample of the same size would yield a margin of error of +/- 2.5 per cent, 19 times out of 20.

About the RE/MAX Network

As one of the leading global real estate franchisors, RE/MAX, LLC is a subsidiary of RE/MAX Holdings (NYSE: RMAX) with more than 140,000 agents in almost 9,000 offices with a presence in more than 110 countries and territories. RE/MAX Canada refers to RE/MAX of Western Canada (1998), LLC and RE/MAX Ontario-Atlantic Canada, Inc., and RE/MAX Promotions, Inc., each of which are affiliates of RE/MAX, LLC. Nobody in the world sells more real estate than RE/MAX, as measured by residential transaction sides. RE/MAX was founded in 1973 by Dave and Gail Liniger, with an innovative, entrepreneurial culture affording its agents and franchisees the flexibility to operate their businesses with great independence. RE/MAX agents have lived, worked and served in their local communities for decades, raising millions of dollars every year for Children's Miracle Network Hospitals® and other charities. To learn more about RE/MAX, to search home listings or find an agent in your community, please visit remax.ca. For the latest news from RE/MAX Canada, please visit blog.remax.ca.

Forward-looking statements

This report includes "forward-looking statements" within the meaning of the "safe harbour" provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such as "believe," "intend," "expect," "estimate," "plan," "outlook," "project," and other similar words and expressions that predict or indicate future events or trends that are not statements of historical matters. These forward-looking statements include statements regarding housing market conditions and the Company's results of operations, performance and growth. Forward-looking statements should not be read as guarantees of future performance or results. Forward-looking statements are based on information available at the time those statements are made and/or management's good faith belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. These risks and uncertainties include (1) the global COVID-19 pandemic, which has impacted the Company and continues to pose significant and widespread risks to the Company's business, the Company's ability to successfully close the anticipated reacquisition and to integrate the reacquired regions into its business, (3) changes in the real estate market or interest rates and availability of financing, (4) changes in business and economic activity in general, (5) the Company's ability to attract and retain quality franchisees, (6) the Company's franchisees' ability to recruit and retain real estate agents and mortgage loan originators, (7) changes in laws and regulations, (8) the Company's ability to enhance, market, and protect the RE/MAX and Motto Mortgage brands, (9) the Company's ability to implement its technology initiatives, and (10) fluctuations in foreign currency exchange rates, and those risks and uncertainties described in the sections entitled "Risk Factors" and "Management's Discussion and Analysis of Financial Condition and Results of Operations" in the most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q filed with the Securities and Exchange Commission ("SEC") and similar disclosures in subsequent periodic and current reports filed with the SEC, which are available on the investor relations page of the Company's website at www.remax.com and on the SEC website at www.sec.gov. Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date on which they are made. Except as required by law, the Company does not intend, and undertakes no duty, to update this information to reflect future events or circumstances.

SOURCE RE/MAX Canada

© Canada Newswire, source Canada Newswire English