Talking Points:

- Larger USDOLLAR Correction on Tap; Bearish RSI Divergence Gathers Pace

- British Pound Poised for Fresh Highs on Bank of England (BoE) Policy Outlook

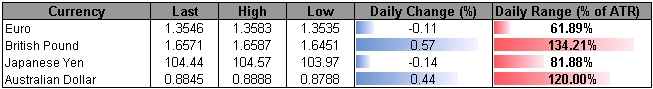

Index | Last | High | Low | Daily Change (%) | Daily Range (% of ATR) |

DJ-FXCM Dollar Index | 10703.15 | 10729.11 | 10687.85 | -0.18 | 102.04% |

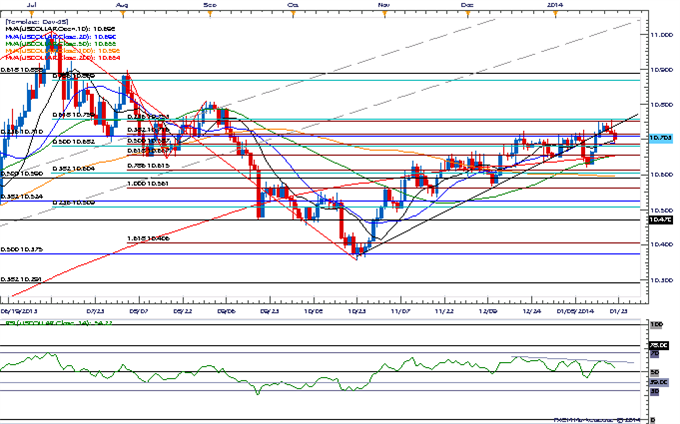

USDOLLAR Daily

Chart - Created Using FXCM Marketscope 2.0

- Downside Targets in View After Carving Higher High (10,756)

- Bearish RSI Divergence Favors ‘Selling Bounces’

- Interim Resistance: 10,753 (23.6 expansion) to 10,759 (61.8 retracement)

- Interim Support: 10,561 (100.0 extension)- Closing Basis

Release | GMT | Expected | Actual |

MBA Mortgage Applications (JAN 17) | 12:00 |

The Dow Jones-FXCM U.S. Dollar Index (Ticker: USDollar) looks poised a larger decline ahead of the Fed meeting as it carves a higher high going into the last full-week of trading for January.

Indeed, the greenback appears to be searching for a higher low as the Federal Open Market Committee (FOMC) is widely expected to discuss another $10B taper next week, but a move below interim support (10,561) may instill a more bearish forecast for the USD as the bearish divergence in the Relative Strength Index (RSI) continues to take shape.

In turn, the near-term correction may turn into a longer-term bearish trend should the Fed further delay its exit strategy, and we favor ‘selling bounces’ ahead of the Fed interest rate decision as long as the RSI divergence remains in play.

Join DailyFX on Demandto Cover Current U.S. Dollar Trade Setups

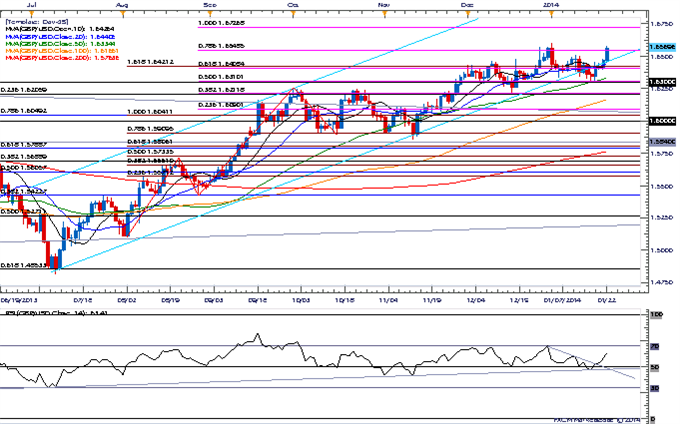

GBPUSD Daily

- Looking for Higher High Following Topside RSI Break

- Interim Resistance: 1.6550 (78.6 expansion) to 1.6600 Pivot

- Interim Support: 1.6300 Pivot to 1.6310 (50.0 expansion)

Two of the four components rallied against the greenback, led by a 0.57 percent advance in the British Pound, and we will look for a higher high in the GBPUSD as the marked decline in U.K. Unemployment sparks a material shift in the policy outlook.

The ongoing improvement in the labor market may force the Bank of England (BoE) to normalize monetary policy ahead of schedule, and we may see Governor Mark Carney turn more hawkish over the near-term as the stronger recovery raises the threat for a housing-bubble.

In turn, we may see the BoE maintain the 7 percent unemployment threshold for its forward-guidance on monetary policy, and the GBPUSD may continue to retrace the decline from back in 2012 as the central bank moves away from its easing cycle.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

By

By