Talking Points:

- US Service-Sector ISM Report in Focus to Start the Trading Week

- Gold Prices Are Eyeing Technical Resistance Near $1250/oz Level

- Crude Oil Selling May Slow After Inventories Fell to 7-Week Low

The spotlight is on the US Non-Manufacturing Composite gauge to start the trading week. Expectations suggest service-sector activity accelerated in December after hitting a five-month low in November. Such an outcome is likely to support speculation about continued “tapering” of the Federal Reserve’s QE asset purchases, boosting the US Dollar and weighing against anti-fiat demand for gold. In the energy space, news-flow supportive of Fed stimulus reduction may weigh on the crude oil prices but losses may prove limited after inventories at the key Cushing, Oklahoma storage facility were reported at the lowest in seven weeks last Friday.

Capitalize on Shifts in Market Mood with the DailyFX Speculative Sentiment Index.

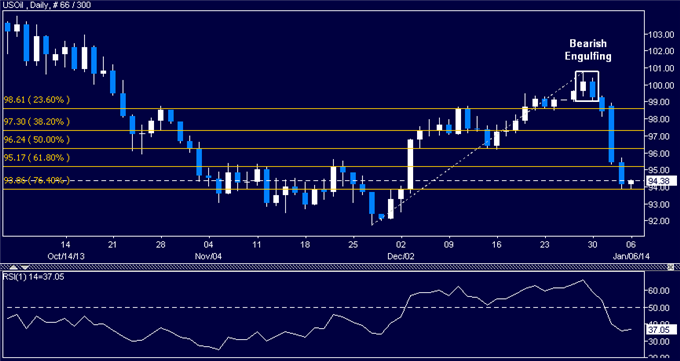

CRUDE OIL TECHNICAL ANALYSIS – Prices fell as expected after putting in a Bearish Engulfing candlestick pattern. A break below 93.86, the 76.4% Fibonacci retracement, exposes the November 26 low at 91.74. Reversing above resistance at 95.17, the 61.8% Fib, targets the 50% retracement at 96.24.

GOLD TECHNICAL ANALYSIS – Prices turned higher as expected after putting in a Harami candlestick pattern. A break above resistance at 1224.39, the 23.6% Fibonacci retracement, has exposed the 38.2% level at 1250.63. A further push beyond that aims for the 50% Fib at 1271.84. The 1224.39 mark has been recast as near-term support.

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

To receive Ilya's analysis directly via email, please SIGN UP HERE

Contact and follow Ilya on Twitter: @IlyaSpivak

original source

By

By