|

|

| This week's gainers and losers |

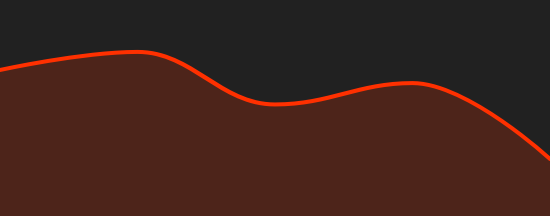

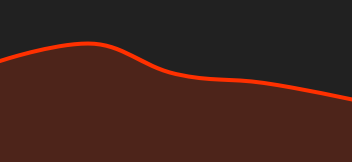

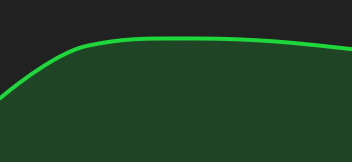

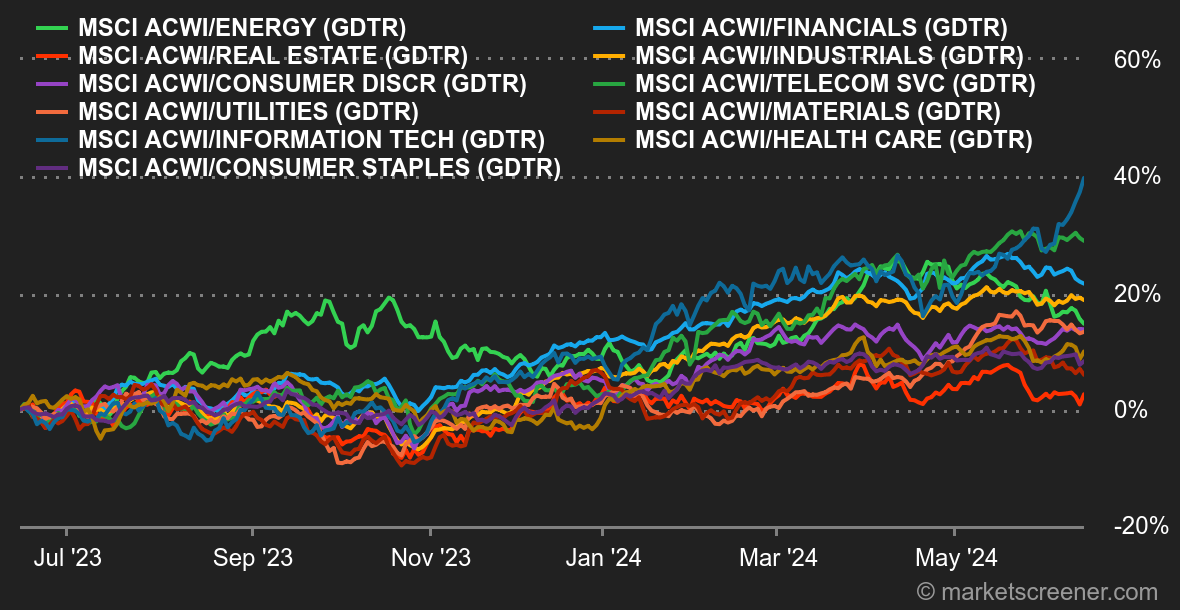

| Gainers: Broadcom (+21%): The group is well on the way to becoming one of the companies benefiting from the artificial intelligence premium. The latest quarterly results published this week show that AI is driving sales. At the same time, the integration of VMWare seems to be going well. Halma (+15%): The diversified group operating in security, healthcare and analytics reported better-than-expected full-year results for the year ended March 31. The British company is confident for the new financial year, thanks to a thick order book and good visibility on margins. ARM Holdings (+16%): Microsoft will work with Taiwanese chip designer Mediatek to develop an AI-compatible ARM chip to run the Windows operating system, Reuters reported. The British company, which entered Wall Street last year, has thus been buoyed. Oracle (+9%): The company closed the week on a high thanks to the publication of its quarterly results. Growing demand for artificial intelligence contributed to this performance, with the signing of over 30 AI contracts worth more than $12.5 billion. Partnerships were also signed with Microsoft and Alphabet, as well as a collaboration with OpenAI to use its cloud infrastructures to train ChatGPT. KKR (+11%): The investment company will enter the S&P500 on June 24, according to S&P Dow Jones index manager. A fine achievement for the company, which is not far from its historic peaks and has reached a market capitalization of $97 billion. It will be joined by CrowdStrike and GoDaddy. Robert Half, Comerica and Illumina leave the US broad index. Apple (+9%): Apple bounces back with Apple Intelligence and its collaboration with OpenAI to integrate ChatGPT with Siri. These announcements, made at the WWDC conference, allayed investors' concerns about a possible delay in the AI race. This rebound propelled the capitalization of Apple, which is now neck-and-neck with Microsoft. Rentokil (+7%): The share escaped the European slump this week, following Bloomberg's revelations about the capital position built up by Nelson Peltz's Trian fund. The activist investor is said to have contacted the British company, which specializes in business services, to discuss strategy. Losers: Wise (-16%): The fintech was heavily penalized after its 2025 earnings forecasts were revised downwards. Its 2024 results, on the other hand, came out rather robust. The new financial year will be marked by weaker growth and margins well below market expectations. Paramount Global (-13%): National Amusements, the controlling shareholder headed by Shari Redstone, broke off negotiations with Skydance Media, ruling out the possibility of a merger between the two entities. Warner Bros. Discovery (-13%): The media giant hits its lowest level in 15 years, as investors worry about growth prospects in the face of the possible loss of NBA broadcasting rights and Liberty Global's interest in buying Warner's stake in Formula E. |

|

| Commodities |

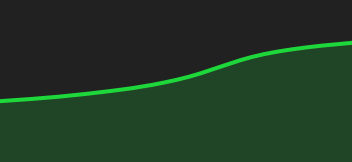

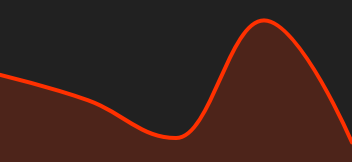

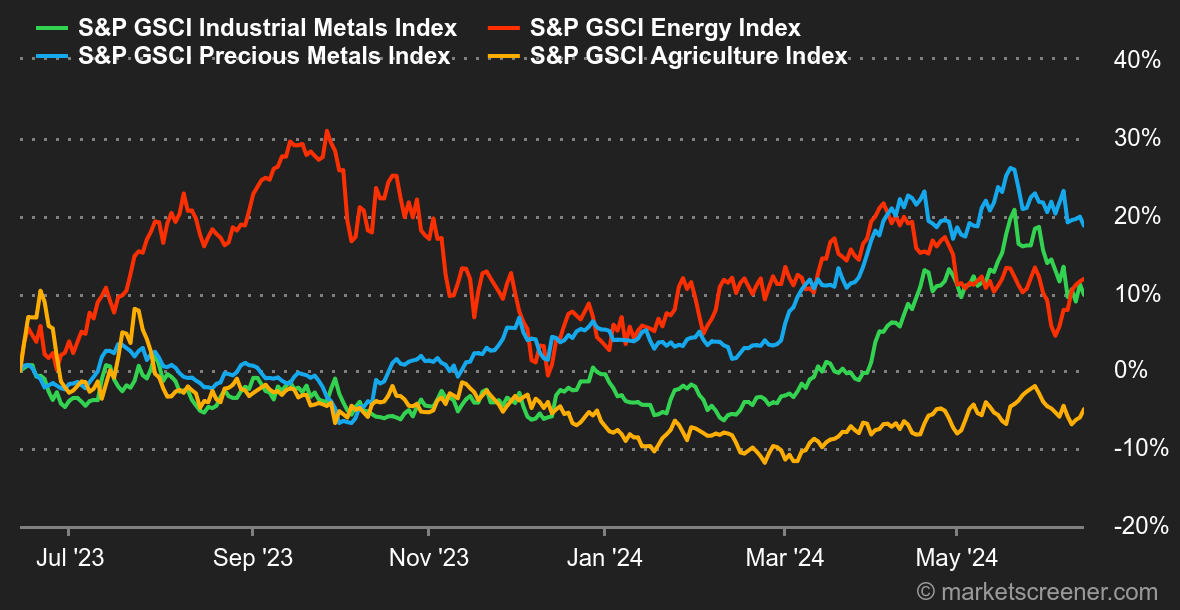

| Energy: Despite headwinds, oil prices are bouncing back energetically this week, with traders focusing on the latest US inflation data. These weaker-than-expected figures give the Fed more room to maneuver in its monetary policy easing, which is excellent news for risky assets. Back to the headwinds: On the one hand, the International Energy Agency once again revised downwards its forecasts for global oil demand growth, and on the other, weekly inventories registered a surprise rise of 3.7 million barrels. On the price front, Brent crude is trading up at around USD 82.6, while WTI is trading at around USD 78. Metals: Consolidation continues in the industrial metals segment. The latest Chinese statistics have done little to arouse financial interest in metals, explaining the lethargy of copper, which is trading in London at USD 9794 (spot price). The same fate befell nickel, which recorded a fourth consecutive week of decline to USD 17645. Gold, on the other hand, is holding its own thanks to a combination of falling US inflation and falling US bond yields. Agricultural products: The bushel of corn rallied in Chicago, supported by concerns about rising temperatures in the United States. The corn contract (expiring July 2024) is trading at 456 cents. Also in Chicago, wheat is struggling to get back on track, stabilizing at around 613 cents (still due July 2024). |

|

| Macroeconomics |

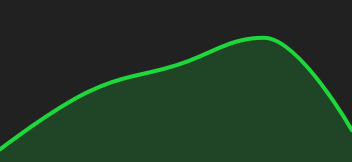

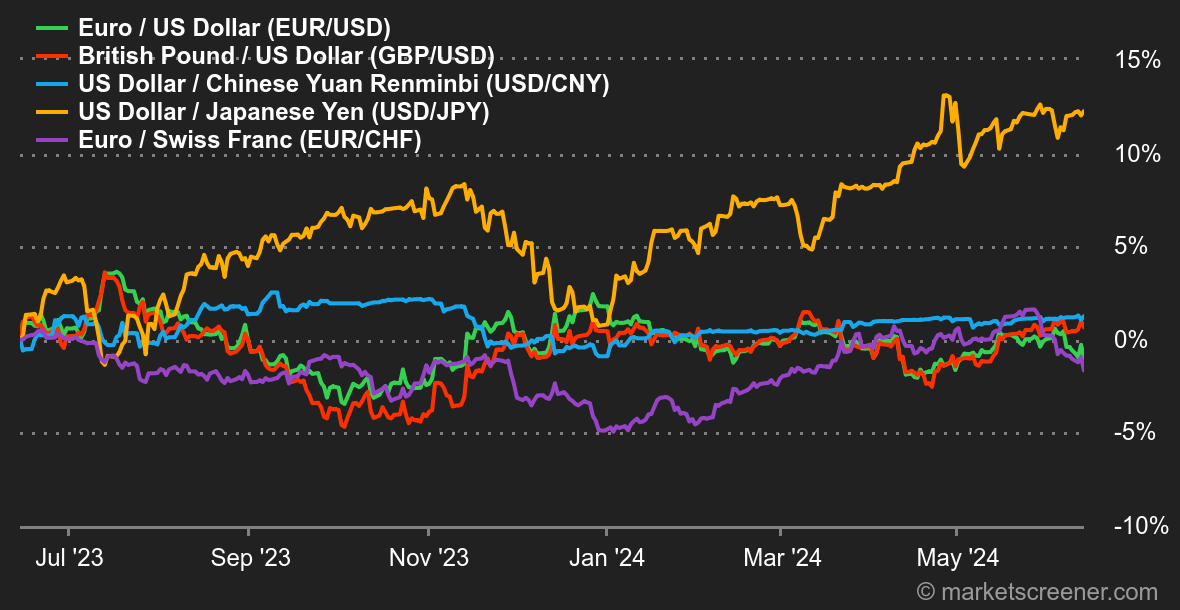

| Atmosphere: The latest data on US inflation was welcomed by investors. CPI came in slightly below expectations at +3.4% y/y vs. +3.5% expected. As for the Fed meeting, it confirmed what the financial community had already suspected: Fed members anticipate a rate cut in 2024, but if the situation continues to improve on the inflation front, Jerome Powell does not rule out two rate cuts. This encouraging news pushed bond yields down in the US, with the 10-year now clearly below 4.33%, with a target of 4.00%. In Europe, the situation is complicated by fears over the outcome of the French parliamentary elections. Even though bond yields have fallen, the differential between France and Germany has never been so high since 2017, pushing the Paris stock market into bright red. This is a situation to be closely monitored. In Japan, the central bank left rates unchanged and did not reduce its asset repurchase program. The second part of the program was unexpected. Equities rebounded and the yen retreated in the face of this more accommodating approach than expected. Crypto: Bitcoin is definitely not finding its way back up the bullish path to catch up with its record high reached last March. The digital currency is down 3.7% this week, falling back below the $67,000 mark. And unlike last week, when over a billion dollars were invested in Bitcoin Spot ETFs in the U.S., net outflows since Monday have been in the region of $500 million. This partly explains the drop in the BTC price this week. For its part, despite speculation that Ethereum Spot ETFs could be launched this summer, ether (ETH) is down for the third week running. Its price has fallen by 5% since Monday, dropping back below the $3,500 mark. More generally, the market was down this week, with the total valuation of all cryptocurrencies falling by almost 5% to around $2,350 billion. |

|

|

| Things to read this week | ||||||

|

|

*The weekly movements of indexes and stocks displayed on the dashboard are related to the period ranging from the open on Monday to the sending time of this newsletter on Friday. The weekly movements of commodities, precious metals and currencies displayed on the dashboard are related to a 7-day rolling period from Friday to Friday, until the sending time of this newsletter. These assets continue to quote on weekends. |

By

By