The global gallium arsenide (GaAs) components market is expected to grow at a CAGR of over 4% during the forecast period, according to Technavio’s latest report.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170112005080/en/

Technavio has published a new report on the global gallium arsenide components market from 2017-2021. (Graphic: Business Wire)

In this report, Technavio covers the market outlook and growth prospects of the global GaAs components market for 2017-2021. By end-users, this market is divided into mobile devices and wireless communications segments.

The global GaAs components market is expected to grow to USD 9.13 billion by 2021, with over 54% of the revenue being generated from the mobile devices segment. The quickly developing 3G and 4G networks are enabling the quick growth of the market segment.

The rising adoption of smartphones and tablets is acting as a major driving factor for this market, with number of smartphone shipments expected to hit 2 billion by 2020. This growth in number of shipments will drive the demand for GaAs components used in mobile handsets, particularly GaAs power amplifiers.

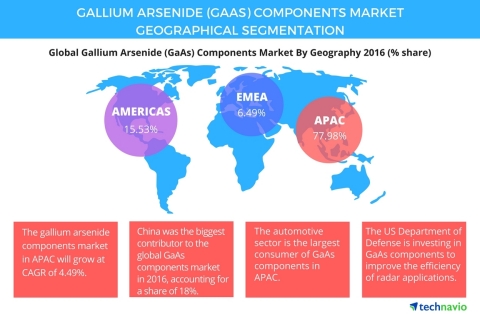

Technavio’s research study segments the global GaAs components market into the following regions:

- APAC

- Americas

- EMEA

APAC: largest GaAs component market segment

“APAC is the global leader in the market, accounting for almost 78% of the total market revenue in 2016. The market dominance is primarily because of the high demand for GaAs components from communication device manufacturers in the region. Also, increasing demand for power applications, along with high-growth economies, is a major driver of the GaAs components market in the region,” says Sunil Kumar Singh, one of the lead analysts at Technavio for embedded systems research.

The increasing smartphone penetration in developing countries and rapidly developing wireless infrastructure are driving the high adoption of GaAs components in the region. Companies such as Samsung, LG, HTC, and Sony are investing heavily to launch better smartphones, which is compatible with 3G/4G technologies. These new-generation mobile phones integrate three to four times more power amplifiers when compared to previous generation smartphones, which means increased demand for GaAs components.

Request a sample report: http://www.technavio.com/request-a-sample?report=55645

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Americas: expansion of 4G networks driving GaAs components market the region

Analysts at Technavio forecast the Americas to showcase a CAGR of 4.31% during the forecast period, of which most of the growth will be driven by the expansion of 4G networks in the region. North America is witnessing rapid expansion of its 4G network to make an easier transition to the upcoming 5G network. Apple and Skyworks Solutions are among the biggest consumers of GaAs components for their application in mobile power amplifiers.

GaAs components also find wide application in radar and defense systems. Currently, the US Department of Defense (DoD) is investing significantly in GaAs components to improve the efficiency of its current radar applications. Additionally, GaAs components are expected to attract demand from the military sector, thereby boosting the revenue contribution from the region.

EMEA: high demand from the automotive industry

“The GaAs components saw maximum adoption from the thriving automotive industry in the region. The region will also invest in the adoption of LEDs for the general lighting and automotive sectors, all of which consume GaAs components. In the defense sector, UMS, an MMIC solution provider from the UK, creates a significant demand for GaAs components,” says Sunil.

The different domains of defense – radar, communication, and smart ammunition are supplied with designs done by UMS or their customers and are based on the UMS technology platform. However, this region will grow at a slower rate when compared to the other two segments as most semiconductor foundries and manufacturing units are present in APAC and the Americas.

The top vendors in the global GaAs market highlighted in the report are:

- Skyworks Solutions

- Qorvo

- Broadcom

Browse Related Reports:

- Global Polyacrylamide Market 2017-2021

- Global Precipitated Silica Market 2017-2021

- Global Electronic Adhesives Market 2017-2021

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like displays, lighting, and sensors. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170112005080/en/