Fidelity Investments® today announced that Morningstar, Inc. has awarded its 2016 Fixed-Income Fund Manager of the Year in the United States to the portfolio managers of Fidelity Total Bond Fund (FTBFX), Ford O’Neil, Matt Conti, Mike Foggin and Jeff Moore. O’Neil, Conti, Foggin and Moore also manage Fidelity Advisor Total Bond Fund1. Fidelity currently manages more than $925 billion2 in fixed income assets, making it one of the largest fixed income asset managers in the world.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170125005994/en/

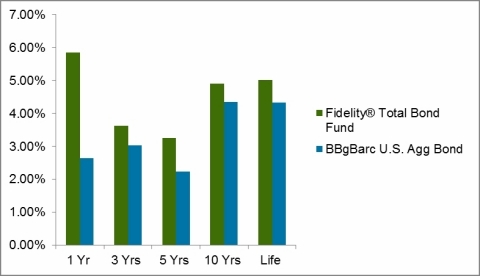

Fidelity Total Bond Fund -- Average Annual Total Returns (Graphic: Business Wire)

According to Morningstar, its annual Fund Manager of the Year award recognizes portfolio managers who demonstrate excellent investment skill and the courage to differ from the consensus to benefit investors. To qualify for the award, managers’ funds must have not only posted impressive returns for the year, but the managers also must have a record of delivering outstanding long-term risk-adjusted performance and of aligning with shareholders’ interests. Nominated funds must be Morningstar Medalists -- a fund that has garnered a Morningstar Analyst Rating™ of Gold, Silver, or Bronze. The Fund Manager of the Year award winners are chosen based on research and in-depth qualitative evaluation by Morningstar’s Manager Research Group.

In recognizing O’Neil and team, Morningstar’s Laura Lutton stated, “Given the fund’s structural exposures to high yield and credit in the previous year, combined with excellent security selection in those allocations, 2016 provided a strong showcase of what Ford and the team do well. In the past, this fund’s performance has been aided by strong security selection and sector allocations.”

A team of experienced managers is behind the success of Fidelity Total Bond Fund, a $25 billion fund with a Morningstar Analyst Rating™ of Gold, which last year beat 96% of its Morningstar peers in the intermediate-term bond category. Past performance is no guarantee of future results. For the most recent fund performance, please visit Fidelity.com. In addition to 26-year Fidelity veteran and lead manager O'Neil, the fund benefits from the expertise of portfolio managers Conti, Foggin, and Moore. Together they have more than 90 years of investment management experience and are also backed by Fidelity’s fixed-income group.

“Fidelity Total Bond Fund has over the years provided investors strong risk-adjusted returns with a one-stop access to a diverse group of fixed-income sectors” said O’Neil. “The broad mandate of Fidelity Total Bond Fund has been key to its ability to outperform in all types of markets and could be especially valuable as interest rates fluctuate in the months ahead.”

Fidelity Total Bond Fund -- Average Annual Total Returns3

Past performance is no guarantee of future results. For the most recent fund performance, please visit Fidelity.com.

“On behalf of Fidelity and the fund’s shareholders, we are truly honored to receive this recognition from Morningstar,” said Charlie Morrison, president of Fidelity‘s Asset Management organization. “Not only does this award recognize the team on Total Bond Fund for its incredible stewardship on the fund, but, just as importantly, it also recognizes the tremendous fixed income organization we have assembled, an organization that is positioned to help us meet the rapidly evolving fixed income needs of our retail and institutional clients.”

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $5.7 trillion, including managed assets of $2.1 trillion as of December 31, 2016, we focus on meeting the unique needs of a diverse set of customers: helping more than 25 million people invest their own life savings, nearly 20,000 businesses manage employee benefit programs, as well as providing more than 12,500 financial advisory firms with investment and technology solutions to invest their own clients’ money. Privately held for 70 years, Fidelity employs 45,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about.

Before investing, consider the investment objectives, risks, charges, and expenses of the fund or annuity and its investment options. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

In general the bond market is volatile, and fixed income securities carry interest rate risk. (As interest rates rise, bond prices usually fall, and vice versa. This effect is usually more pronounced for longer-term securities.) Fixed income securities also carry inflation risk and credit and default risks for both issuers and counterparties. Unlike individual bonds, most bond funds do not have a maturity date, so holding them until maturity to avoid losses caused by price volatility is not possible. Any fixed income security sold or redeemed prior to maturity may be subject to loss.

The Bloomberg Barclays U.S. Aggregate Bond Index is an unmanaged market value-weighted index for U.S. dollar denominated investment-grade fixed-rate debt issues, including government, corporate, asset-backed, and mortgage-backed securities with maturities of at least one year.

For the one, three-, five- and 10-year periods ending 12/31/16, Fidelity Total Bond Fund’s rank in the Morningstar Intermediate-term Bond category was 4%, 11%, 22% and 19%, respectively. There were 985, 869, 759, and 541 funds in the Morningstar category over the same periods, respectively. Percent Rank in Category is the fund's total-return percentile rank relative to all funds that have the same Morningstar Category. The highest (or most favorable) percentile rank is 1 and the lowest (or least favorable) percentile rank is 100. The top-performing fund in a category will always receive a rank of 1. % Rank in Category is based on total returns which include reinvested dividends and capital gains, if any, and exclude sales charges.

Morningstar’s Manager Research Group consists of various wholly owned subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC. Analyst Ratings are subjective in nature and should not be used as the sole basis for investment decisions. Analyst Ratings are based on Morningstar’s Manager Research Group’s current expectations about future events and therefore involve unknown risks and uncertainties that may cause such expectations not to occur or to differ significantly from what was expected. Analyst Ratings are not guarantees nor should they be viewed as an assessment of a fund’s or the fund’s underlying securities’ creditworthiness. This press release is for informational purposes only; references to securities in this press release should not be considered an offer or solicitation to buy or sell the securities.

The Manager of the Year award is presented each year to recognize a

manager’s past achievements.

Morningstar fund analysts specializing

in the fixed income field narrow the universe for the award to five

nominees, and the winner is then selected by Morningstar’s entire team

of mutual fund analysts. The award is presented to fund managers who

have distinguished themselves over the past calendar year and have

achieved strong risk-adjusted historical performance through the careful

execution of a solid investment strategy and responsible fund

stewardship.

The Morningstar Analyst Rating is a subjective, forward-looking

evaluation that considers a combination of qualitative and quantitative

factors to rate funds on five key pillars: process, performance, people,

parent, and price. Gold is the highest of four Analyst Rating

categories. For the full rating methodology, go to Morningstar.com

For

the Fidelity Total Bond Fund report, go to http://performance.morningstar.com/fund/ratings-risk.action?t=FTBFX.

.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem

Street, Smithfield, RI 02917

Fidelity Investments Institutional Services Company, Inc.,

500

Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC,

200 Seaport

Boulevard, Boston, MA 02110

788428.1.0

©2017 FMR LLC. All rights reserved.

1 Classes A, C, T, I and Z of Fidelity Advisor Total Bond Fund are classes of Fidelity Total Bond Fund

2 As of December 31, 2016

3 As of 12/31/2016; Fund Inception 10/15/2002; Average annual total return is a historical rate of return that, if achieved annually, would have produced the same cumulative total return if performance had been constant over the entire period. Average annual total returns smooth out variation in performance; they are not the same as actual year-by-year results.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170125005994/en/