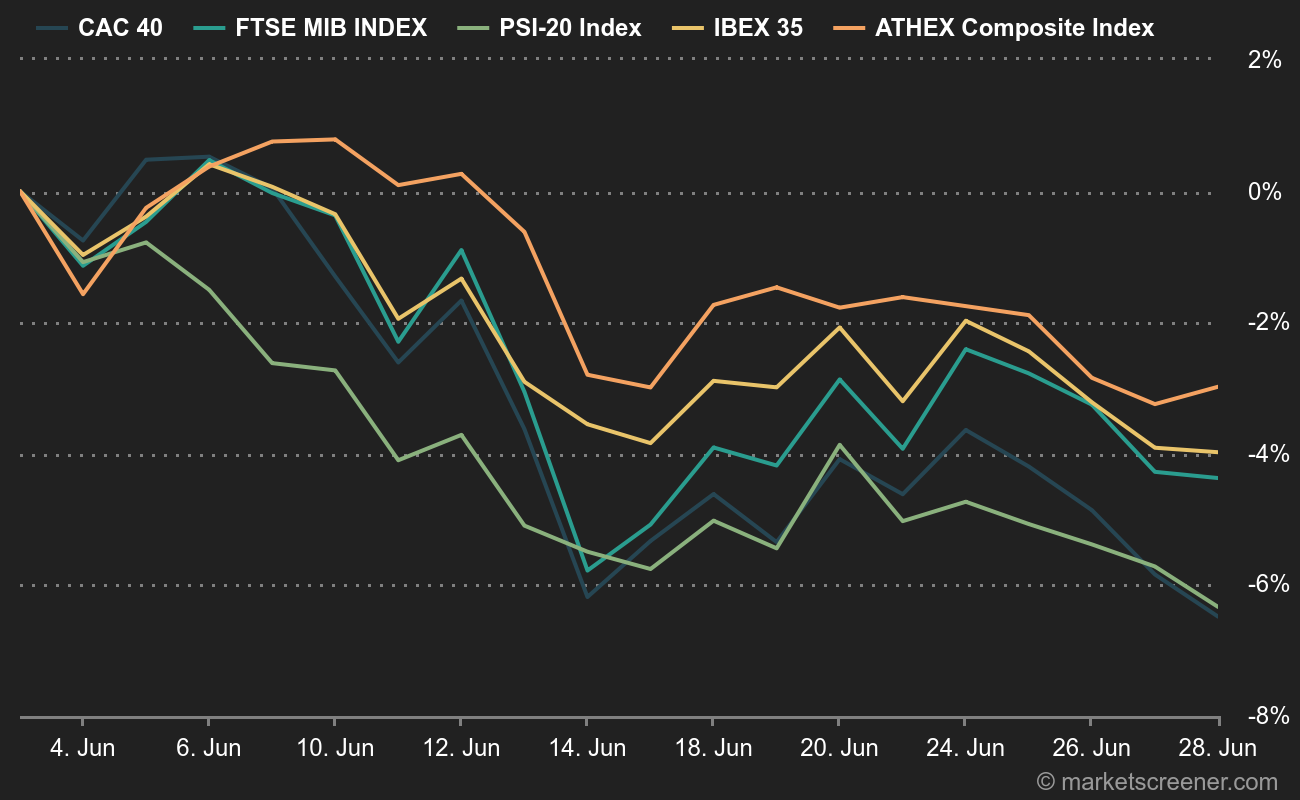

Last week, the results of the European Parliament elections and the rise of far-right parties in many of the continent's countries sent shockwaves through the markets. A large proportion of Europe's national indices fell the day after the vote.

Since then, the situation has deteriorated. In France, worries about the dissolution of the National Assembly and the outcome of the upcoming legislative elections weighed on the flagship index. Down 6.3% in 5 sessions, the Cac 40 posted its worst week since early 2022.

Already weakened by its luxury goods stocks, the index was hit by falls in the banking sector (BNP Paribas, Société Générale, Crédit Agricole), state services (Engie, Veolia), toll operators (Vinci) and other sectors.(Vinci, Eiffage), whose nationalization the markets fear, and other heavyweights (Saint-Gobain, Aéroports de Paris).

Southern countries in Paris' wake

While Standard and Poor's already downgraded France's credit rating a few weeks ago, the widening Franco-German spread is also clouding the outlook for neighboring markets. Largely held by European investors, French OAT yields are rising, fueling doubts about the country's public finances and dragging southern countries into the red.

Small and mid caps in the eye of the storm

On both sides of our borders, small and mid caps are particularly hard hit by the current situation. More sensitive to borrowing rates than their elders, small and mid caps in Spain (IBEX small and IBEX medium) and Germany (SDAX and MDAX), in particular, are bearing the brunt of the prevailing gloom.

Paris has lost its position as Europe's leading stock market to London due to the backlash. While the Cac has erased its gains of the year, British equities are benefiting from a resurgence in popularity and a (relative) political lull, despite the imminent UK elections.(on July 4) and a recent poll that puts Nigel Farage's far-right Reform UK party in second place in terms of voting intentions, ahead of the Conservatives. According to Bloomberg, London is now worth $3,180 billion, compared with $3,130 billion for Paris.

With the European elections behind them, the FTSE 100 and the Swiss SMI weathered last week's bearish wave better than their southern European counterparts.

By

By