Houston-based Westlake Chemical, a leading producer of polyolefins in North America and a global leader in the chlor-vinyl chemicals segment, is positioning itself to capture synergies and strengthen its market position as the chlor-vinyl market strengthens, according to new analysis from IHS Markit (Nasdaq: INFO), a world leader in critical information, analytics and solutions.

This press release features multimedia. View the full release here: http://www.businesswire.com/news/home/20180122005201/en/

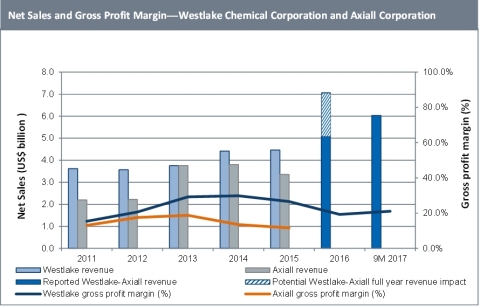

Net Sales and Gross Profit Margin -- Westlake Chemical Corporation and Axiall Corporation. Source: IHS Markit

According to the IHS Markit report entitled the Westlake Chemical Competitive Company Analysis, Westlake had reported revenue of $5.08 billion in 2016, Westlake was ranked in 66th place on the IHS Chemical Week “Billion Dollar Club 2017” list (ranking of chemical companies, by revenue), based on 2016 revenue.

“Westlake Chemical has traditionally been a major regional chemical producer in the U.S., but has diversified its portfolio through acquisition of Vinnolit (2014), and Axiall (2016),” said Mohit Sood, senior principal chemical analyst at IHS Markit and lead author of the IHS Markit Westlake competitive company report. “Additionally, the company has made timely investments in North American ethylene production by undertaking capacity additions, debottlenecking and feedstock conversion projects, which have allowed it to capitalize ethane feedstock availability in the region. This in turn, has ensured Westlake’s margin expansion along the vinyl’s chain.”

Sood said Westlake has the lowest ethylene cash-cost among major chemical producers, which is driving higher margins, and the company is strengthening its position as a market leader in the polyethylene and chlor-vinyl’s market.”

Westlake solidified its position as a major chlor-vinyl producer with recent acquisitions of Axiall, a U.S. producer, and Vinnolit, a European producer. According to Sood, Westlake is experiencing robust revenue growth and has a largely solid financial position with reasonable debt levels, which enables the company greater flexibility to take advantage of market opportunities and capture synergies, such as its recent acquisitions.”

The Axiall acquisition substantially increased the company’s product diversity along the chlorine chain, while the Vinnolit acquisition helped diversify and expand its operations to Europe, and provided access to critical vinyls technology, noted the IHS Markit report. This expansion is enabling Westlake to transition beyond commodity chemicals to the more profitable specialty PVC (poly-vinyl chloride) production, where Europe has a leading global position.

According to the IHS Markit analysis, Westlake is the leader in terms of vinyl chloride monomer (VCM) production, it ranks second in terms of ethylene dichloride (EDC) and third globally in terms of both chlorine and caustic soda production. Westlake is the leader in terms of production capacity for low-density polyethylene (LDPE) in North America and is among the top five linear low-density polyethylene (LLDPE) producers in the United States. The company uses autoclave technology for LDPE production, which helps produce high-margin specialty polyethylene products.

However, Westlake has no high-density polyethylene (HDPE) production. The Axiall acquisition has enhanced the ethylene deficit for Westlake, but the company does have first rights to increase its ownership to 50 percent in the New Lake Charles, La. (U.S.) cracker project (with Lotte) within the first three years of completion.

“Westlake’s ethylene business is highly integrated into the polyolefins and chlor-vinyl’s chain,” said Steve Lewandowski, global business director of light olefins at IHS Markit. “Following the Axiall Corporation integration in 2016, the EDC integration for Westlake has increased from 0.5 million metric tons (MMT) per year to 1.4 MMT per year. This has enhanced the net-short ethylene position for Westlake in 2017, but we at IHS Markit expect this shortfall to moderate once the Lotte-Axiall cracker comes on stream in Lake Charles, in 2020, assuming the company significantly increases its stake in the project, as expected. Presently, the company is primarily reliant on third-party suppliers of ethylene for its U.S. and European operations.”

According to Lewandowski, Westlake continues in its strategic growth plan. “Westlake has focused on its ethylene-chain integration by debottlenecking existing assets, changing feed slate on another to an advantaged feedstock, and finally, through a merger, has taken an equity position in a green-field cracker build,” Lewandowski said. “With these changes, it has reduced the production of propylene, a non-core product. Westlake now has many options to consider—such as investing in additional backward integration to ethylene in the U.S., or taking a position in Europe on ethylene production to develop integration there.”

Westlake, in line with other ethylene producers in the U.S., has invested in various projects to benefit from the advantaged feedstock position in the region, said IHS Markit. Westlake completed its conversion of Calvert City, (La.) ethylene feedstock from 100 percent propane to 100 percent ethane in 2014. However, Westlake has the flexibility to process 100 percent propane in the event that the feedstock price scenario changes.

The company also completed ethylene capacity at Lake Charles, increasing capacity by 110,000 metric tons per year, and the company plans to increase Calvert City ethylene capacity by 30,000 metric tons per year by end 2017.

Westlake pursues a strategy of product concentration and vertical integration through acquisitions, expansions and modifications of existing plants, and new projects. With that in mind, Sood said, “The company is leveraging its pipeline connectivity across sites to capture synergies and improve operational efficiencies. Westlake has a 50 percent stake in a natural gas pipeline that supplies feedstocks to the Lake Charles, cracker site. This helps the company improve the long-term reliability of feedstock supply at the site and its North American portfolio concentration, to drive greater profitability. In addition, Westlake’s downstream integration into PVC -fabricated products offers higher value, specialty products.”

While the company continues to expand its position in the vinyl’s segment, Westlake’s olefins segment is more profitable that the vinyl’s segment. In 2016, the olefins segment contributed about 76 percent to the company’s total income from operations, while the vinyl’s segment contributed just 25 percent. This is in contrast with sales contributions from both the segment as sales from olefins segments contributed only 37 percent to the overall sales of the company, while vinyl’s segment contributes around 63 percent.

Westlake has witnessed a substantial increase in EBITDA as a percentage of total revenue since 2008. The company’s EBITDA percentage surged from 2 percent in 2008, to 30 percent in 2014, before returning to 20 percent level in 2016.

Aside from its ethylene deficit, which the company is addressing, the only other significant vulnerability for Westlake, IHS Markit said, is the company’s limited geographical diversification and continued heavy revenue dependence on North America, which makes it more susceptible than its peers to any volatility in the country’s economy.

Despite this, IHS Markit expects that continued North America chlor-alkali industry consolidation will aid remaining larger industry players like Westlake, which stand to benefit from prospective increased pricing power position. Additionally, the Minamata Convention on Mercury and its potential impact on the carbide-based PVC industry in China can open new market opportunities for export-focused U.S. vinyl producers, the IHS Markit report said. Westlake will also benefit from the improved vinyl’s operating rates during the next five years, which should boost the company’s margins.

The growing chlor-vinyl’s market will be a key focus of discussions at the upcoming IHS Markit 33nd Annual World Petrochemical Conference (WPC), March 19 – 24, 2018, at the Houston Hilton Americas Hotel. WPC is the premier annual international gathering of chemical industry leaders, experts, government officials and policymakers, as well as leaders from key end-use markets and technology innovators. To view the current agenda for WPC 2018: 33nd Annual World Petrochemical Conference and register for the event or the training workshops please visit: https://wpc.ihsmarkit.com/

MEDIA REGISTRATION: The WPC 2018 will include an on-site workroom for media, featuring internet access, ample workspace and a dedicated staff liaison to assist with facilitation of interviews. Credentialed members of the news media interested in covering the event can do so free of charge pursuant to their advanced registration approval, and their acceptance of the event media policy. Contact Melissa Manning at melissa.manning@ihsmarkit.com or +1 713-906-2901. Please send your name, organization, phone, e-mail and organization website.

For more information regarding the IHS Markit Westlake Competitive Company Analysis, please contact stacy-ann.wilson@ihsmarkit.com. To speak with Mohit Sood or Steve Lewandowski, please contact melissa.manning@ihsmarkit.com.

About IHS Markit (www.ihsmarkit.com)

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions. Headquartered in London, IHS Markit is committed to sustainable, profitable growth.

IHS Markit is a registered trademark of IHS Markit Ltd. and/or its affiliates. All other company and product names may be trademarks of their respective owners © 2018 IHS Markit Ltd. All rights reserved.

View source version on businesswire.com: http://www.businesswire.com/news/home/20180122005201/en/