To receive Ilya's analysis directly via email, please SIGN UP HERE

Talking Points:

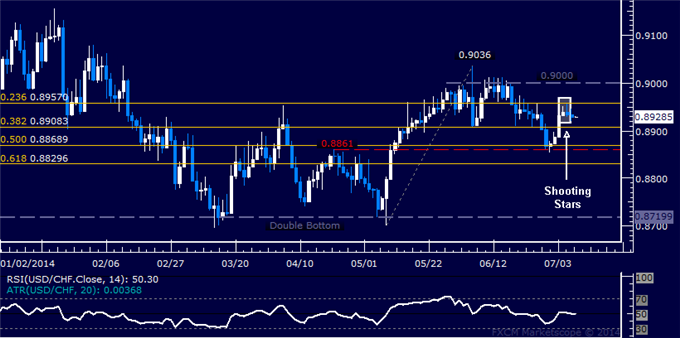

- USD/CHF Technical Strategy: Flat

- Support:0.8908, 0.8861, 0.8830

- Resistance: 0.8957, 0.9000, 0.9036

The US Dollar seems to have run out of steam against the Swiss Franc after meeting resistance below the 0.90 figure. A pair of Shooting Star candlesticks hints at ebbing upside momentum and warns a pullback may be ahead. Near-term support is at 0.8908, the 38.2% Fibonacci retracement, with a daily close below that exposing the 0.8861-69 area marked by the 50% level and the April 22 high. Alternatively, a reversal above the 23.6% Fibat 0.8957 clears the way for a test of the targeting the 0.90 threshold and the June 5 high at 0.9036.

Shooting Star candles signal indecision and confirmation is needed to make for an actionable trade signal. Furthermore, we see the overall USD/CHF trend as broadly bullish. As such, we will look for any on-coming decline as chance to look for buying opportunities.

Add these technical levels directly to your charts with our Support/Resistance Wizard app!

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for DailyFX.com

original source