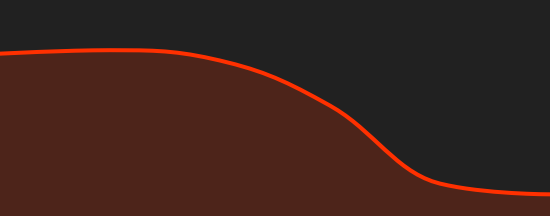

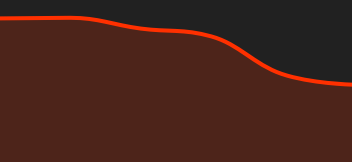

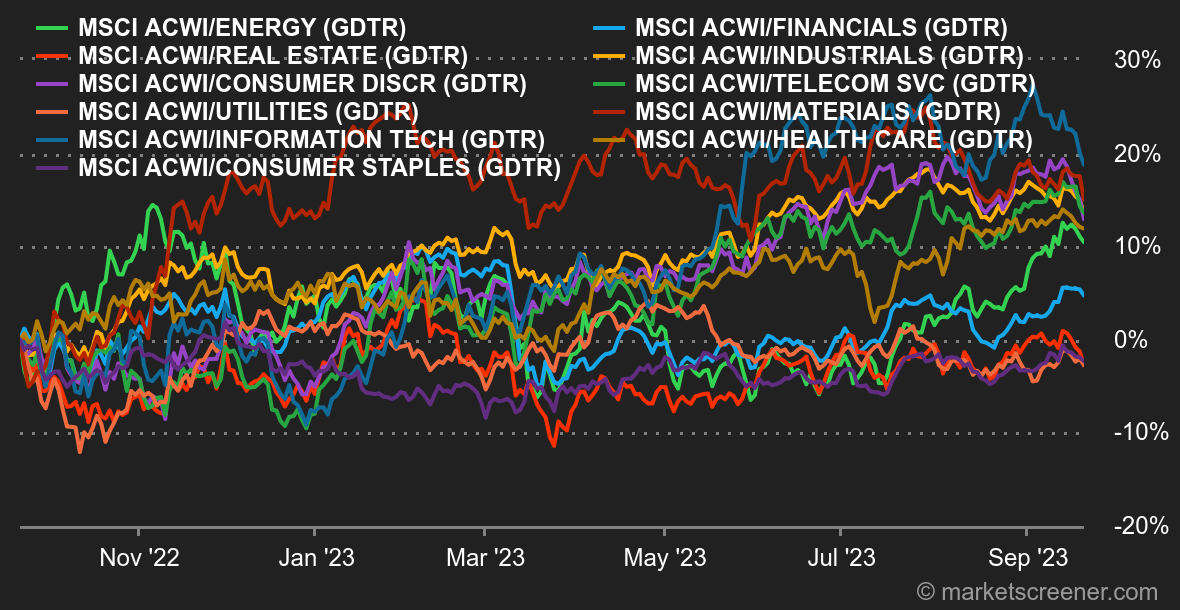

Atmosphere: The hawks are out. The Bank of Japan has just closed the central bank ball and, oh surprise, has done nothing! Understandably, its rates are unchanged and its stance very accommodating. Unfortunately, the same cannot be said of the Bank of England and the US Federal Reserve. Although they have left their key rates unchanged, they have maintained a hawkish stance. In other words, they are in the "rates are going to stay high for a long time" camp, for most if not all of next year. And without ruling out further rate hikes to combat inflation. That's all it took for US 10-year yields to surpass the highs recorded last October, at 4.33%, paving the way for a continuation of the upward trend towards 5%. The collateral effect is to put pressure back on US equities, with increased risk on technology stocks.

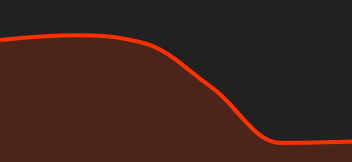

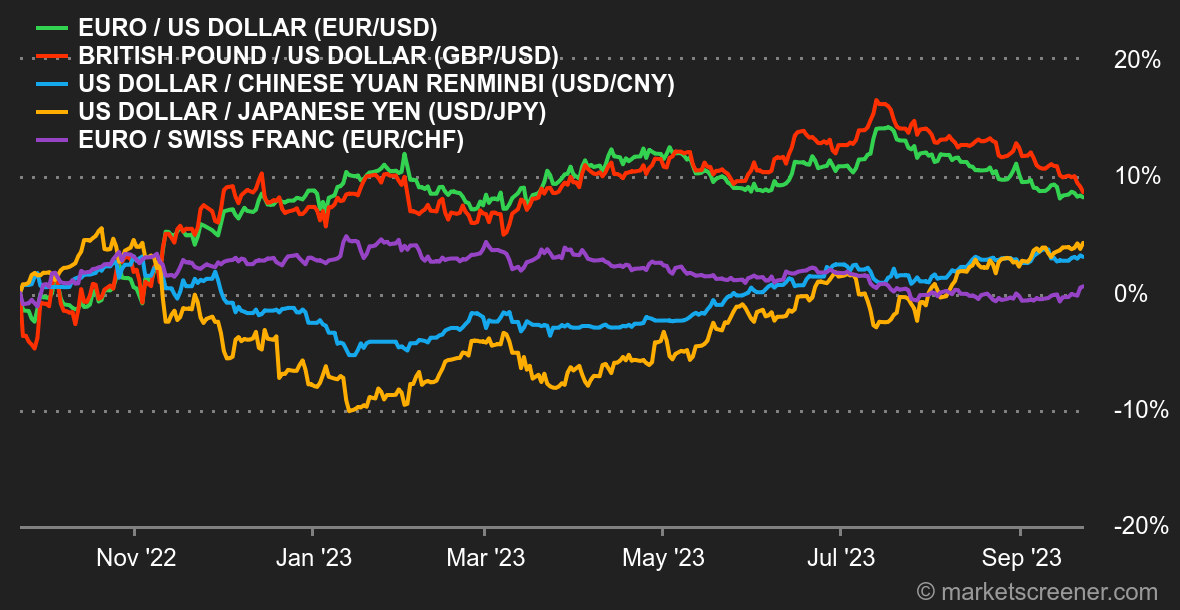

Against this backdrop, the dollar is doing well. It is keeping other currencies under pressure, even though the euro rebounded on Friday, climbing back to USD 1.0649. In addition, the Swiss National Bank's unexpected standstill on interest rates on Thursday gave the single currency a slight boost to CHF 0.9644.

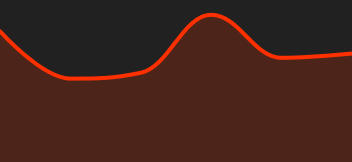

Lastly, the leading PMI indicators for the major European economies are still in contraction territory, despite a tremor in services in Germany and a twitch in industry in the UK. In the US business activity remained steady in September. The US Composite PMI index, which tracks the manufacturing and service sectors, inched down to 50.1 in September from a 50.2 in August.

Crypto: Bitcoin remains in equilibrium this week, hovering around $26600 at the time of writing. Ether suffers a little more than the market leader, dropping 1.63% since Monday, to fall back below the $1600 mark. As the U.S. Securities and Exchange Commission (SEC) continues to tighten the screws on crypto-asset legal compliance, the industry is desperately looking for positive vibes to retain some optimism. For the time being, without a clear regulatory framework and coupled with an economic climate that is unfavorable for risky assets, the crypto-currency market is still unable to recapture investor fervor.

|

By

By