Talking Points

- USD/MXN consolidates below key cyclical pivot

- USD/JPY fails at minor Fibo

- NZD/USD records new multi-year low

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

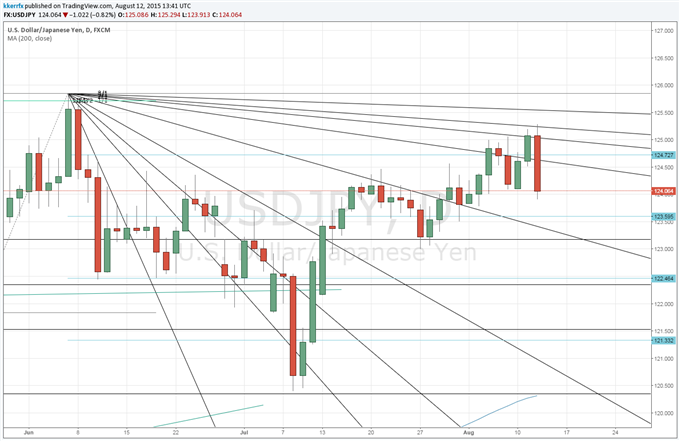

Price & Time Analysis: USD/JPY

ChartPrepared by Kristian Kerr

- USD/JPY traded at its highest level in two months this morning before reversing sharply

- Our near-term trend bias is higher in the exchange rate while above 124.00

- A daily close above 125.20 is needed to re-instill upside mometum into the exchange rate

- A minor turn window is eyed on Friday

- A close below 124.00 will turn us negative on USD/JPY

USD/JPY Strategy: Like the long side while above 124.00 (closing basis).

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/JPY | 123.60 | *124.00 | 124.05 | 124.70 | *125.20 |

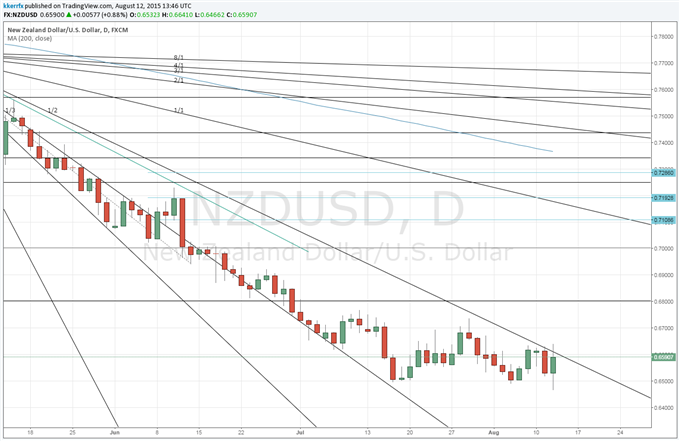

Price & Time Analysis: NZD/USD

ChartPrepared by Kristian Kerr

- NZD/USD fell to a new multi-year low this morning before reversing sharply

- Our near-term trend bias is lower in the kiwi while below .6680

- Weakness back under .6500 is needed to re-instill downside momentum in the rate

- A minor turn window is seen tomorrow

- A daily close above .6680 would turn us positive on NZD/USD

NZD/USD Strategy: Like short side while below .6680

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

NZD/USD | .6465 | *.6500 | .6590 | .6640 | *.6680 |

Focus Chart of the Day: USD/MXN

USD continues to perplex. The FXCM dollar basket USDOLLAR has struggled with a Fibonacci retracement at 12,050, but it has also failed to exhibit any real negative technical action whenever it has failed at resistance. Another chart that typifies the uncertainty in the dollar is USD/MXN. As we highlighted a couple of weeks ago (read here), the exchange rate peaked out during an interesting cyclical window as it came right around 3.14 years from the 2012 high (the closing high for July actually came within one trading day of an exact relationship). It is still up in the air as to just how important this peak is. It could just be a relatively minor pause before another run higher or it could be the start of a much deeper setback. Last month’s low around 16.0000 looks important in this regard as a move below there would suggest that the exchange rate is embarking on a more important move lower. Strength through 16.4900 would obviously invalidate the burgeoning negative cycle path and set the stage for another leg higher in USD/MXN.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

original source