According to the latest market study released by Technavio, the beer market in Europe is expected to grow at a steady CAGR of more than 1% during the forecast period.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170102005035/en/

Technavio has published a new report on the beer market in Europe from 2016-2020. (Graphic: Business Wire)

This research report titled ‘Beer Market in Europe 2016-2020’ provides an in-depth analysis of the market in terms of revenue and emerging market trends. This report also includes an up to date analysis and forecasts for various market segments and all geographical regions.

According to Manjunath Reddy, a lead analyst at Technavio for alcoholic beverages research, “The increasing demand for craft beer has led to an increase in the number of craft breweries in Europe. Moreover, increasing health consciousness among consumers has led to an increase in the demand for low/non-alcoholic beer which is likely to drive the growth of the market during the forecast period.”

Request a sample report: http://www.technavio.com/request-a-sample?report=55388

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

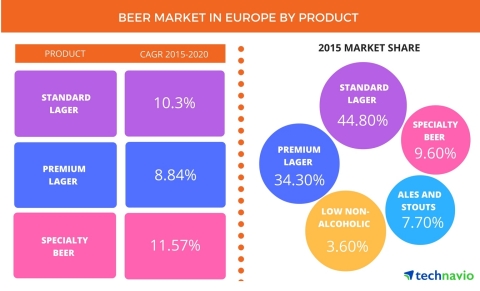

The market research analysis categorizes the beer market in Europe into five major product segments. They are:

- Standard lager

- Premium lager

- Specialty beer

- Ales and stouts

- Low/non-alcoholic beer

Standard lager market in Europe

In the highly competitive beer market, innovations play an important role, which is changing the state of the market in Europe. Preference for specialty beers and low/non-alcoholic beers has increased. Though the consumption rate of standard lager has decreased, the growth of the standard lager beer market is expected to be steady during the forecast period. Standard lager is still one of the most preferred types of beers in European countries such as Czech Republic, Poland, and Slovakia.

Premium lager market in Europe

The increasing demand for premium products due to improvement in living standards and an increase in disposable incomes is increasing the demand for premium lager products in the European market. The demand for flavored lager is also increasing in major markets such as the UK, Romania, and Poland as consumers are increasingly demanding new and innovative products. It is estimated that these markets together will account for almost 70% of the volume sale of flavored lager during the forecast period.

Specialty beer market in Europe

Creative marketing along with an increase in disposable income and preference for better-quality beer is expected to drive the growth of the specialty beer market in Europe. Though the preference for specialty beer has increased, mass consumption cannot be expected as higher production costs for specialty beers lead to higher prices.

Ales and stouts market in Europe

There will be a revival of the ales and stouts beer market in Europe during the forecast period. Innovations in the market will result in increased demand for a variety of ales and stouts. Craft ales and stouts are also growing in demand among consumers in the European market. Private label products are also making inroads into the market as the lower price of private label products makes it more affordable to the consumers. Supermarket chains such as Tesco have come out with their private label offerings of ale and stout products.

Low/non-alcoholic beer market in Europe

Low/non-alcoholic beer is now being widely accepted by consumers in Europe. Brewers in Europe are continuously innovating as there is a huge long-term sales potential for low/non-alcoholic beer in Europe. Availability of healthier forms of beer has resulted in increased frequency of consumption, driving the growth of the low/non-alcoholic beer market in Europe.

“Brewers are focusing on female-centric branding and trying to educate potential consumers about the low alcohol content and lower calorie levels. Launched in 2012, the European Beer Pledge, which focuses on reducing alcohol-related harm, is also a major driver for the growth of the European non-alcoholic beer market, especially among binge drinkers and people who drive home after partying at night,” says Manjunath.

The top vendors highlighted by Technavio’s food and beverage market research analysts in this report are:

- Anheuser-Busch InBev

- Carlsberg

- Heineken

- OETTINGER

- Radeberger

Browse Related Reports:

- Global Beer Packaging Market 2016-2020

- Global Beer Market 2016-2020

- Food Retail Market in Saudi Arabia 2016-2020

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like food,food service, andnon-alcoholic beverages. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170102005035/en/