Commercial Banking: Bank of America (BAC):

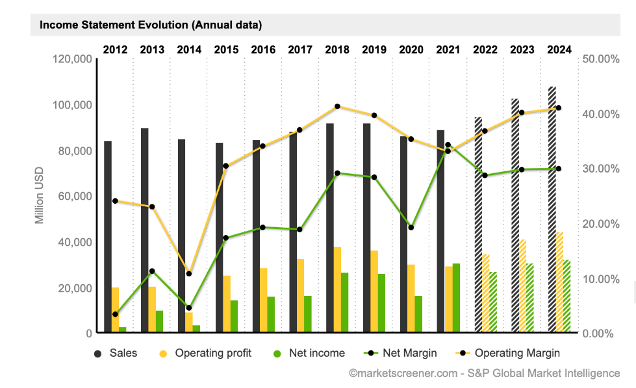

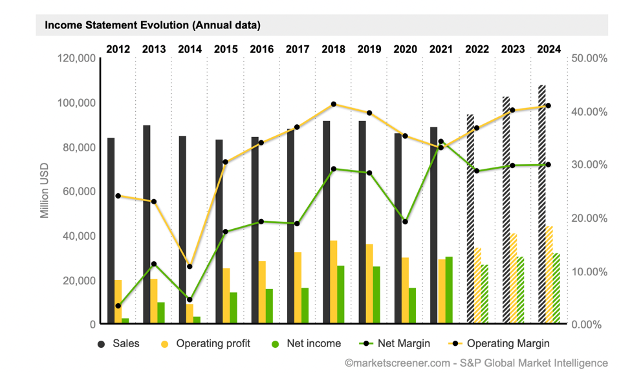

Bank of America is the second largest US bank behind JPMorgan Chase & Co and the seventh largest company in the world. It is organized around five business areas: commercial banking, corporate and investment banking, wealth and asset management, market banking, and others for an average annual return of 19.5% over the past 10 years. Bank of America's share price has experienced various trend cycles and has been in an upward cycle since 2011, despite previous financial crises.

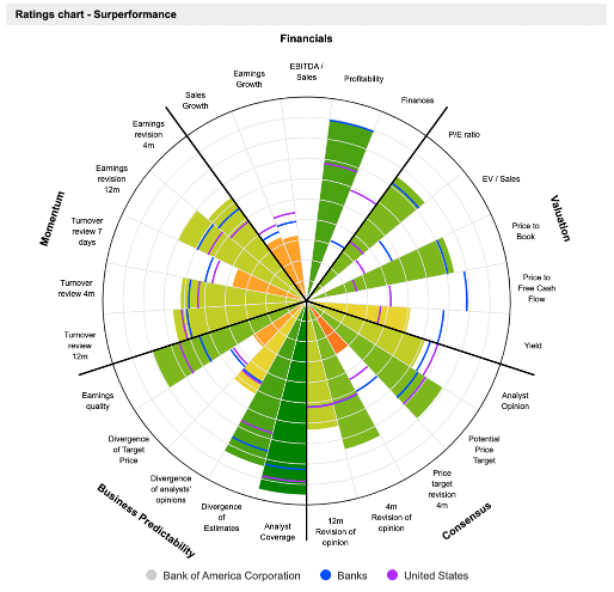

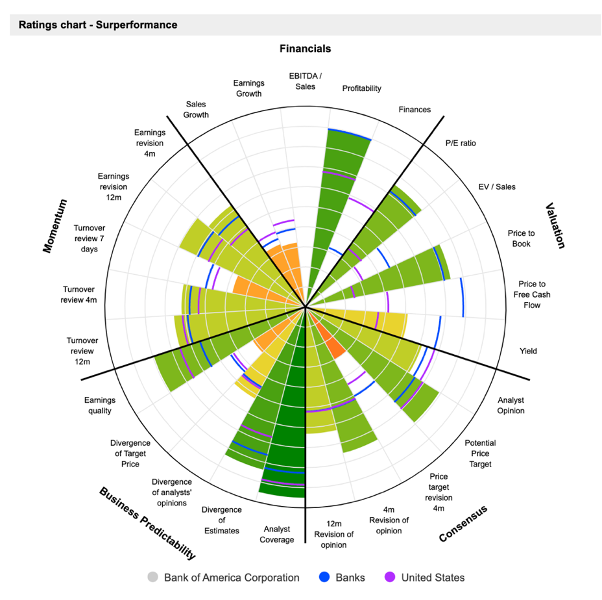

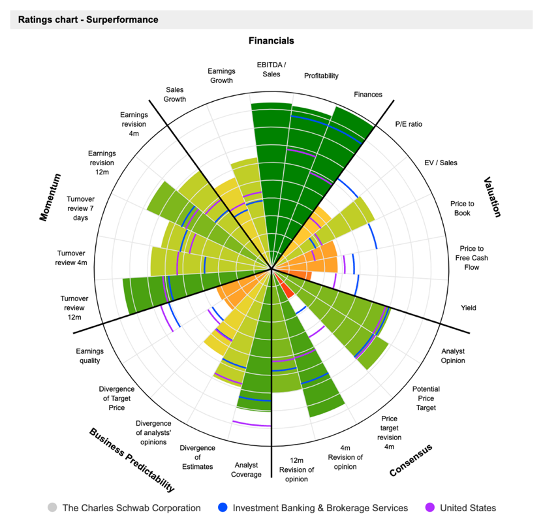

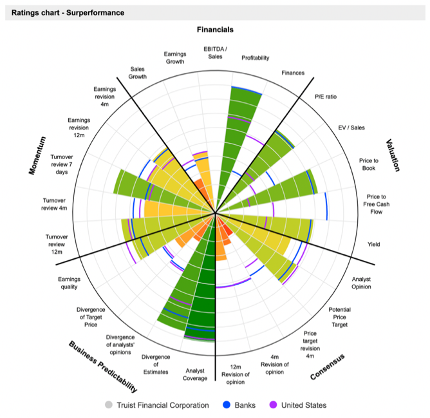

Source: MarketScreener – Rating chart - Superformance

Bank investments are traditionally risky bets, and are among the most volatile stocks in the market. With the current inflation, the Fed's monetary policy and rate hike, and the recession that will follow, the financial-banking sector has been hit hard and Bank of America's stock has fallen 28.40% in the last six months. But this rate hike - which is good for banks - can serve as an entry point for investors with the stock price cut almost in half.

The company can count on strong operating earnings with growth expectations for the coming years as the dividend per share has been rising for the past few years. Bank of America will consolidate its position in the market and expand access to primary health care, especially since its profitability is among the best in the market and its coverage by analysts is one of the most influential. The coming recession will allow Bank of America, as 57.5% of its activities is commercial banking, to attract more customers by offering lower rates than the market and its competitors, such as JP Morgan.

Bank of America's stock should rise comfortably in the coming months, especially since investment banks with large capital have announced price targets of $48. The pandemic has allowed many, many companies to develop and grow, but they've been significantly overvalued, and in this context of inflation and recession. This is why its capitalization is struggling to grow, but is stabilizing around $300 billion, while its revenue is increasing and its P/E is decreasing to 9.44 for 2022, very slightly below that of Morgan Stanley. As for its ROE, it is increasing and was 12.2% in 2021, slightly lower than its competitors and its ROA is 1.05% in 2021 and according to forecasts, should be 1.04% in 2024, much higher than Goldman Sachs' forecast of 0.82%.

Credit Cards: Visa (V):

Visa is an electronic payments company serving consumers, businesses, financial institutions and governments in more than 200 countries and territories. Its flagship VisaNet network is one of the most powerful in the world, capable of processing more than 65,000 transactions per second. Visa was one of the companies whose stock price benefited the most during the pandemic, due to an increase in orders placed over the Internet. Despite a 7.92% decline over the past six months, the most powerful bank card company in the U.S. is expected to rebound soon despite the looming recession.

However, the group has significant growth prospects, particularly in emerging markets, for the coming years. The decline of the more traditional payment methods such as cash and checks provide Visa with an opportunity to further expand its customer base. The Visa Group is resisting rising inflation very well at the moment, and should also resist the recession. The company can count on strong profitability and particularly high net margins. Its financial position appears to be excellent and the visibility it provides allows analysts to issue strong potential valuation reports.

Brokerage and Banking services: Charles Schwab Corporation (SCHW):

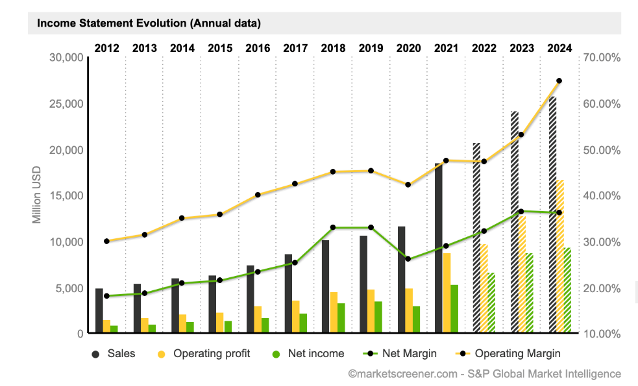

The Charles Schwab Corporation specializes in brokerage and banking services. It operates in two distinct segments: Brokerage & Banking Services to Individual Investors and Investment Services to Institutional Investors. As with many businesses linked to the banking system, the company has high volatility and the announcement of a 0.75% increase in key rates on Wednesday accentuates the 26.68 decline over the past six months.

Charles Schwab's stock, currently at $61.51, is seen as bullish by many banks and financial institutions with price targets of $84. The company can rely on strong financial reports and high net margins. Charles Schwab's P/E is reported at 17.7 for 2022, while Morgan Stanley's is reported at 10.3. At the same time, its ROE is 2% higher than Morgan Stanley's. Despite a low ROA, Charles Schwab sees its ROA increase by 116.6% since 2021.

Insurance: W. R. Berkley Corporation (WRB):

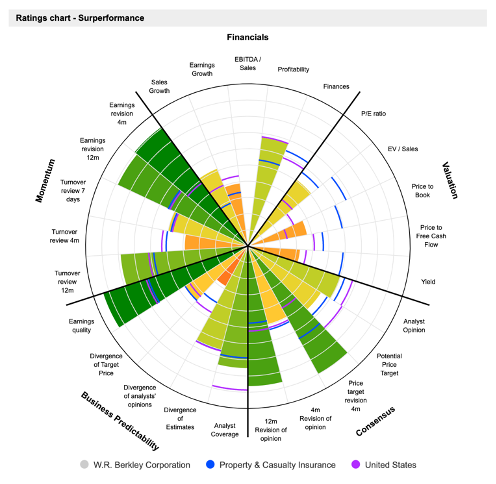

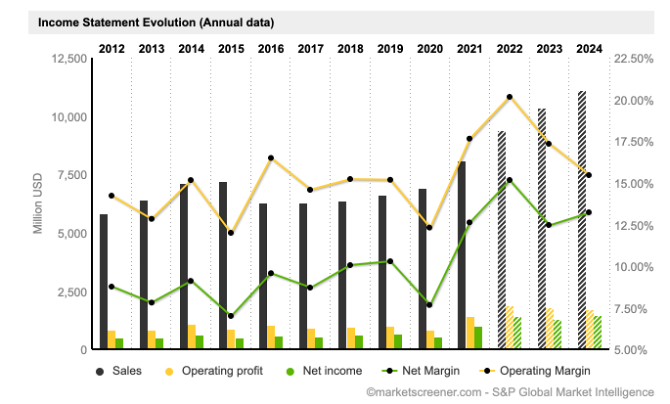

W.R. Berkley Corporation is a holding company organized around 2 areas of activity: Insurance – which include non-life accident and life insurance – and reinsurance, such as business insured for an average annual return of 25,7% over the past 10 years. It was one of the company whose stock price benefited the most since the beginning of the year with an increase of 21,33%. The share price has been up for five consecutive years, as solid earnings have strengthened investors' confidence in the company.

The outlook for the insurance industry is positive, despite the historic year of uncertainty regarding claims levels due to the pandemic. Demand for auto insurance was heavily impacted by the Covid criris, as people drove less and new car sales were at their lowest since 2012. But despite this and the recession, people will still need insurance for their cars, which makes W. R. Berkley Corporation a growth value opportunity. At the same time, analysts have been gradually revising upwards their EPS forecast for the upcoming fiscal year and historically, the company has been releasing earnings that are above expectations.

Financial Holding: Truist Financial Corporation (TFC):

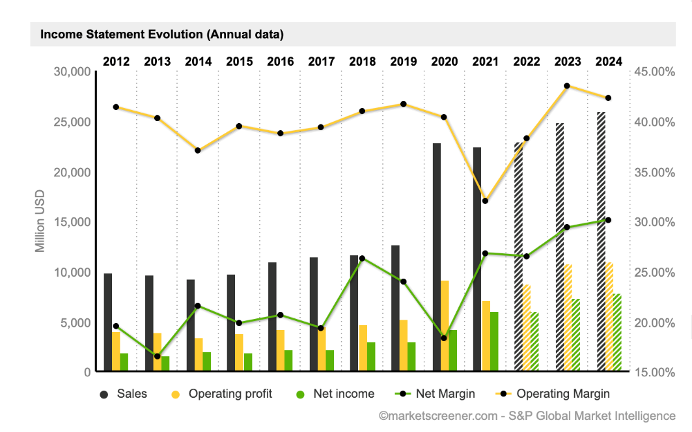

Truist Financial Corporation is a financial holding company organized around 2 business segments: Banking activities including the sale of traditional and specialized banking products and services, financial services provision including asset management, auto financing, brokerage and securities services. Its market capitalization doubled between 2018 and 2019 to reach $75,525 million and is now stabilizing around $62,000 million. Despite a 21.29% decline over the past six months, Truist Financial Corporation is hoping for a rebound from the upcoming recession

By

By