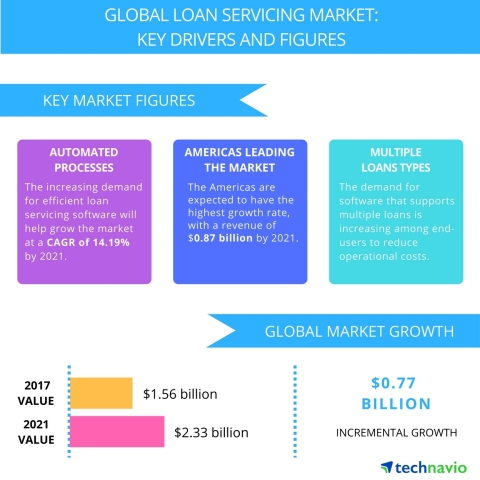

Technavio market research analysts forecast the global loan servicing software market to grow at a CAGR of more than 14% during the forecast period, according to their latest report.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170111005432/en/

Technavio has published a new report on the global loan servicing software market from 2017-2021. (Graphic: Business Wire)

The market study covers the present scenario and growth prospects of the global loan servicing market for 2017-2021. The report also presents a detailed analysis of the key vendors in the market, along with a comprehensive analysis of the emerging trends and challenges faced by the vendors.

According to Amit Sharma, a lead analyst at Technavio for enterprise application research, “Loan servicing software has emerged as a feasible software solution that allows the banks, credit unions, and startup loan servicing operations to manage a higher volume of loans. It also performs the day-to-day needs of portfolio management as well as complete reporting capabilities.

Request a sample report:http://www.technavio.com/request-a-sample?report=55531

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

Technavio ICT analysts highlight the following three market drivers that are contributing to the growth of the global loan servicing market:

- Need for automated process

- Need to comply with multiple regulations

- Supports multiple loans types

Need for automated process

The increasing demand for the lending market has given rise to efficient loan servicing software that helps the lenders in managing loan databases and debt collection activities. Loan servicing software works at a very high speed as compared to manual loan processing and origination. This software does not require any workforce to operate it. Therefore, loan servicing software is increasingly being adopted by insurance companies, commercial lenders, credit unions, consumer loan providers, and structured settlement companies because of the highly flexible and dynamic features provided by the vendors in their loan servicing software offerings.

“Loan servicing software automates loan decisions and is a big factor in increasing the speed of service and borrower satisfaction. Furthermore, it eliminates the need for slow and error-prone manual data entry and paper submission,” says Amit.

Need to comply with multiple regulations

Organizations are expected to follow regulatory requirements to protect and manage the corporate information. Governments of many countries are enforcing acts and policies, such as Sarbanes–Oxley (SOX) Act and the Health Insurance Portability and Accountability Act (HIPAA) in the US, and data breach notification laws that companies need to comply with for conducting business effectively.

Enterprises in the banking, insurance, and healthcare sectors develop rigorous IT security policies to comply with external regulations as they deal with sensitive information. Loan servicing software reduces the manual work with automation and secure delivery of critical information. This has encouraged end-users, especially mortgage banks and credit unions, to adopt loan servicing software that meets the necessary regulatory requirements. Thus, the need for regulatory compliances has also increased investments in loan servicing software.

Supports multiple loans types

The demand for loan servicing software that supports multiple loans is increasing among end-users to reduce operational costs, enhance regulatory compliance, increase loan portfolio quality, and control bad debt losses. Several vendors in the market are providing loan servicing software that supports multiple loan origination and processing process across end-users, eliminating vendor dependency and internal IT staff involvement.

Loan servicing software enables lending organizations to minimize financial risk exposure in addition to increasing their operational efficiency. Loan servicing software also supports a wide variety of loan industries and lending products that include SME lending, peer-to-peer lending, mortgage lending, payday loans, credit unions, microfinance, retail lending, POS financing, auto lending, and medical financing. Loan servicing software handles the mortgage, home equity, and other consumer loans on one platform. All these factors are collectively increasing the adoption of loan servicing software

Browse Related Reports:

- Global Online Financing Platform for SMBs Market 2016-2020

- Global Consumer Credit Market 2016-2020

- Global Peer-to-peer Lending Market 2016-2020

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like IT hardware,IT professional services, andIT security. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170111005432/en/