According to the latest market study released by Technavio, the global automotive powertrain sensors market is expected to grow at a CAGR of close to 6% during the forecast period.

This Smart News Release features multimedia. View the full release here: http://www.businesswire.com/news/home/20170105006090/en/

Technavio has published a new report on the global automotive powertrain sensors market from 2017-2021. (Graphic: Business Wire)

This research report titled ‘Global Automotive Powertrain Sensors Market 2017-2021’ provides an in-depth analysis of the market in terms of revenue and emerging market trends. This market research report also includes up to date analysis and forecasts for various market segments and all geographical regions.

There has been a rising demand for fuel-efficient, safe, and low emission vehicles in the automotive industry. End-users are more concerned about vehicle security, environmental safety and a need for better performance, which is creating a healthy demand for powertrain sensors. Most of the demand for automotive powertrain sensors market is arising from developing countries in APAC.

Stringent regulations regarding emission control, growing adoption of automatic transmission vehicles, a rapid electrification of automotive components increasing application of electronics in vehicles, and advances in inertial measurement unit (IMU) manufacturing technologies are the other key drivers of this market. These drivers are expected to drive the global automotive powertrain sensors market to be valued at USD 26.52 billion by 2021.

Request a sample report: http://www.technavio.com/request-a-sample?report=55409

Technavio’s sample reports are free of charge and contain multiple sections of the report including the market size and forecast, drivers, challenges, trends, and more.

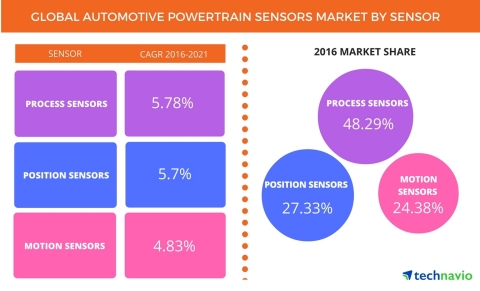

Based on sensor type, the report categorizes the global powertrain sensors market into the following segments:

- Process sensors

- Position sensors

- Motion sensors

Process sensors

Process sensors are mainly used to monitor temperature and pressure for applications about passenger safety and vehicle security. These sensors are increasingly used in the automotive segment for optimizing the performance of the powertrain and engine. In terms of revenue, the global process sensors market was valued at USD 9.81 billion in 2016 and is expected to reach USD 12.99 billion by 2021, growing at a CAGR of 5.78%.

“The manifold absolute pressure sensor measures the vacuum in the engine and leads to optimal fuel injection and ignition time. Similarly, temperature sensors are offered for measuring the temperature of engine coolant. The development of these sensors allowed the original equipment manufacturers to optimize engine operation and make the vehicle extremely efficient. Apart from passenger cars, process sensors are also gaining traction in commercial vehicles,” says Neelam Barua, one of the lead analysts at Technavio for automotive electronics research.

Position sensors

Analysts at Technavio expect the growing demand for the vehicle stability enhancement system to drive the market for position sensors during the forecast period. Camshaft and crankshaft position sensors are currently witnessing the highest adoption rates among position sensors in the automotive segment. These sensors are crucial for altering the timing of a valve lift event, which leads to improved performance and fuel economy.

Currently, the market is witnessing a shift toward selective catalytic reduction (SCR) technology for better fuel efficiency. In the passenger cars segment, SCR technology is employed by several original equipment manufacturers (OEMs) such as Mercedes-Benz, BMW, and VW. The SCR technology in commercial vehicles is gaining traction with the implementation of Euro VI and BS IV norms.

Motion sensors

“Speed or motion sensors are becoming crucial for the vehicles sold across the world owing to the dependence of many advanced systems on information from speed sensors. One such system is advanced anti-lock braking system that provides efficient braking and stability during emergency braking and is widely adopted in both passenger cars and commercial vehicles. Additionally, the increasing electrification of mechanical components in vehicles is also contributing to the adoption of anti-lock braking systems,” says Neelam.

Most of the vehicles introduced recently are equipped with transmission input speed sensors and transmission output speed sensors. These sensors provide the vehicle control unit with the rotational speed of the input and output shaft, which is used to allow the vehicle to shift smoothly and run efficiently. The vendors in this market have adopted the economies of scale concept, which means the cost of these sensors has greatly reduced, thereby positively impacting the revenue from the segment.

The top vendors highlighted by Technavio’s research analysts in this report are:

- Bosch

- Continental

- Sensata Technologies

- Texas Instruments

- NXP Technologies

- Maruta Manufacturing

Browse Related Reports:

- Global Automotive Sensors Market 2016-2020

- Global Automotive LIDAR Sensors Market 2016-2020

- Global Sensor Module Market in the Automotive Sector 2016-2020

Become a Technavio Insights member and access all three of these reports for a fraction of their original cost. As a Technavio Insights member, you will have immediate access to new reports as they’re published in addition to all 6,000+ existing reports covering segments like automotive components, automotive manufacturing, and automotive services. This subscription nets you thousands in savings, while staying connected to Technavio’s constant transforming research library, helping you make informed business decisions more efficiently.

About Technavio

Technavio is a leading global technology research and advisory company. The company develops over 2000 pieces of research every year, covering more than 500 technologies across 80 countries. Technavio has about 300 analysts globally who specialize in customized consulting and business research assignments across the latest leading edge technologies.

Technavio analysts employ primary as well as secondary research techniques to ascertain the size and vendor landscape in a range of markets. Analysts obtain information using a combination of bottom-up and top-down approaches, besides using in-house market modeling tools and proprietary databases. They corroborate this data with the data obtained from various market participants and stakeholders across the value chain, including vendors, service providers, distributors, re-sellers, and end-users.

If you are interested in more information, please contact our media team at media@technavio.com.

View source version on businesswire.com: http://www.businesswire.com/news/home/20170105006090/en/