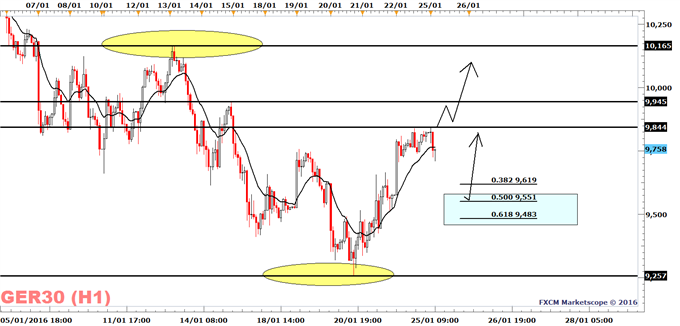

The DAX is trading sideways in the very short-term and a break to last week’s high of 9844 may lift the index to the January 14 high of 9945. However, this does seem less likely today given that the German IFO Expectations Index declined to 102.4 from 104.1.

If a bullish break to 9844 does not occur today, then a pullback to the support range of 9551 to 9483 seems likely. In this range and from a technical perspective, the risk/reward ratio is favourable for long positions (as I am of the opinion that last week’s low of 9257 may hold).

The reason for my bullish bias is the current dovish stance beingportrayed by the ECB, which may cut rates at their next rate meeting. Also U.S. Markit Mfg. PMI rose to 52.7 from 51.2 in December while new orders rose to 53.7 from 50.2 and this suggests that the manufacturing sector may not be as soft as suggested by the ISM indicator.

Later today, Dallas Fed Manufacturing index is on tap and may help to figure out if the Markit PMI or ISM is leading the way. A Bloomberg poll projects an outcome of -14 from -20.1 in December.

Learn What FXCM’s Most Successful Traders Do on a Consistent Basis, sign up for our free guide here.

DAX 30 | FXCM: GER30

Created with Marketscope/Trading Station II; prepared by Alejandro Zambrano

--- Written by Alejandro Zambrano, Market Analyst for DailyFX.com

Contact and follow Alejandro on Twitter: @AlexFX00

Struggling with Trading? Join a London Seminar

Get Alejandro’s daily market update in your inbox, please fill out this form

original source