What many call a bubble has been able to form due to the super-low interest rates driven by quantitative easing programs from central banks. The abundance of liquidity following the 2008 crisis has led investors to chase yields, which plummeted while bond prices soared.

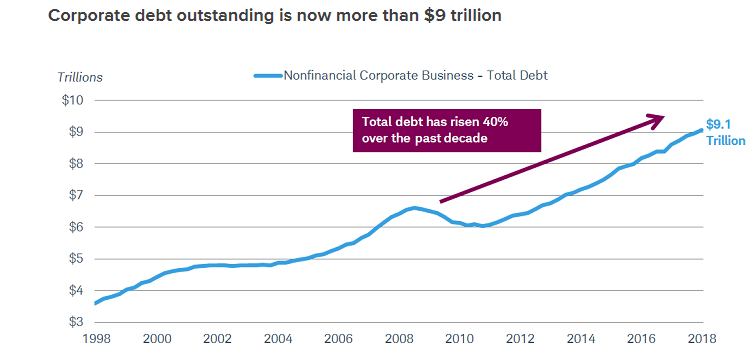

Total outstanding non-financial corporate debt has rocketed by over 40% since its 2008 high. It has even jumped to more than $9 trillion as of the first quarter of this year.

Source: Charles Schwab, using quarterly data from Bloomberg as of 1Q 2018. FOF Nonfarm Nonfinancial Corp Business Credit Market Instruments Liability (CDNSCBIL Index).

However, Collin Martin, an analyst at Charles Schwab, believes this won’t happen anytime soon: “While we do see risks brewing in the corporate bond market, we don’t think investors necessarily need to exit their corporate bond investments in the near term, as there are plenty of factors that can keep the market supported for now.”

It believes that there are plenty of supporting factors that can prevent corporate bond prices from falling sharply over the next six to 12 months. Despite the rise in debt outstanding, it notes that corporations are well positioned to service this large amount of debt, as corporate earnings remain strong. According to data from the Federal Reserve, nonfinancial corporate businesses held $2.6 trillion in liquid assets on their balance sheets.

Another factor, according to Collin Martin, is healthy corporate earnings and the strength of the U.S. economy. “Despite concerns about the growing amount of debt, the yields that corporate bonds offer relative to U.S. Treasuries are very low, so investors aren’t being compensated well for these growing risks. For now, we suggest a neutral allocation to both investment-grade corporate bonds and high-yield corporate bonds.”

By

By